Are you wondering what the future holds for Sydney’s property market?

As we head toward 2025, the Sydney property scene is showing promising yet complex trends. While the pace of price growth has softened compared to previous years, values continue to rise modestly due to surging demand and a critical undersupply of properties.

Buyers and investors who understand these trends are poised to benefit, but as the market continues to shift, it’s more crucial than ever to consult professionals like those at

PB Property to make well-informed, strategic moves. Here’s a deep dive into the latest data, trends, and predictions for Sydney’s property market in 2025.

Sydney Property Prices and Market Growth

Sydney’s property values increased steadily in 2024, though not at the breakneck speed seen in past cycles. In September, property prices grew by 0.2%, bringing the annual growth rate to 4.5%.

What’s driving this resilience? The interplay of demand and supply. Although more properties have been listed for sale, demand remains high, supported by buyer and seller confidence. Many buyers are encouraged by potential interest rate cuts, which could soon expand borrowing capacity, giving them more purchasing power.

CoreLogic data shows Sydney dwelling prices soared by 25.4% from the onset of COVID-19 to a peak in January 2022, then dipped by 13.8% by January 2023. Today, prices are just 1.4% below that peak, and with limited supply, record-breaking prices are likely on the horizon. However, Sydney’s property market isn’t uniform—performance varies significantly across suburbs.

Why the 2025 Market is Primed for Growth

Several factors are contributing to the ongoing growth potential in Sydney’s property market:

- Shortfall in New Dwelling Approvals: Approval rates for new dwellings have dropped amid supply chain issues, rising construction costs, and restrictive government policies. With a housing supply that’s already in crisis, this situation has only worsened, making existing properties even more desirable.

- Government Policies: Changes in policy continue to impact the market. High property taxes and complex approval processes discourage new housing developments, tightening the market even further and creating a “perfect storm” that pushes property and rental prices up.

- Population Growth and Demand for Housing: As Australia’s borders reopened in 2022, Sydney welcomed a wave of new residents—many of whom are skilled immigrants and international students seeking both rental properties and homes to purchase. The Australian Bureau of Statistics (ABS) reported a 2.1% population increase for Sydney in 2023, with projections pointing to over 9 million residents in the next decade.

Where to Invest in Sydney’s Property Market in 2025

With Sydney’s complex market dynamics, knowing where to invest is essential. Here’s a look at three property types that are expected to perform well in 2025:

1. Family Homes in Premium Suburbs

High demand for family homes in Sydney’s prestigious inner-ring suburbs continues to drive property values in these areas. As families increasingly prioritise space and proximity to amenities, properties in affluent areas are poised to maintain steady demand and solid growth. Key suburbs include:

- Eastern Suburbs: Randwick, Coogee, and Maroubra offer proximity to the CBD, beaches, and top-tier schools, making them highly sought-after.

- Lower North Shore: Family-friendly suburbs like Willoughby, Lane Cove, and Artarmon provide excellent schools, abundant green spaces, and easy CBD access.

- Northern Beaches: Dee Why, Mona Vale, and Freshwater cater to families seeking a relaxed coastal lifestyle with access to quality schools and outdoor amenities.

Investing in these suburbs offers not only high rental demand but also strong long-term capital growth. Quality family homes, especially those with 3-4 bedrooms on larger plots, remain in limited supply, adding to their value.

2. Townhouses in Gentrifying Middle-Ring Suburbs

As standalone houses become less accessible, townhouses in Sydney’s middle-ring suburbs are growing in popularity among both investors and owner-occupiers. These properties offer affordability relative to detached homes, along with desirable living space and proximity to urban amenities. Middle-ring suburbs worth considering include:

- Inner West: Suburbs like Marrickville, Dulwich Hill, and Petersham appeal to young professionals and families with their vibrant culture and CBD access.

- St George Area: Hurstville, Kogarah, and Carlton have benefited from infrastructure upgrades and proximity to the CBD, airport, and educational institutions.

- North-West Growth Corridor: Rouse Hill, Kellyville, and Castle Hill are popular due to expanding infrastructure, shopping centres, and schools.

Modern 3-4 bedroom townhouses in these areas provide competitive rental yields and appeal to buyers and tenants who value space, privacy, and functionality.

3. Boutique Apartments in Lifestyle Hubs

High-density apartment developments have lost their appeal, but boutique apartments in lifestyle-focused neighbourhoods remain resilient. These low-rise apartments, often located in vibrant suburbs with easy access to amenities, cater to young professionals, students, and downsizers. Top areas include:

- Eastern Suburbs: Bondi, Bronte, and Coogee attract tenants and buyers alike with their proximity to the beach and lively social scene.

- Inner Suburbs: Surry Hills, Darlinghurst, and Redfern are known for their urban appeal, attracting young professionals with cafes, nightlife, and convenient transport links.

Investors seeking boutique apartments should focus on well-designed, spacious 1-2 bedroom units with quality finishes and features like balconies and modern amenities. These properties tend to yield stable rental income and attract a steady stream of tenants, particularly when located close to lifestyle attractions and transport networks.

Sydney’s Tight Rental Market and the Growing Crisis

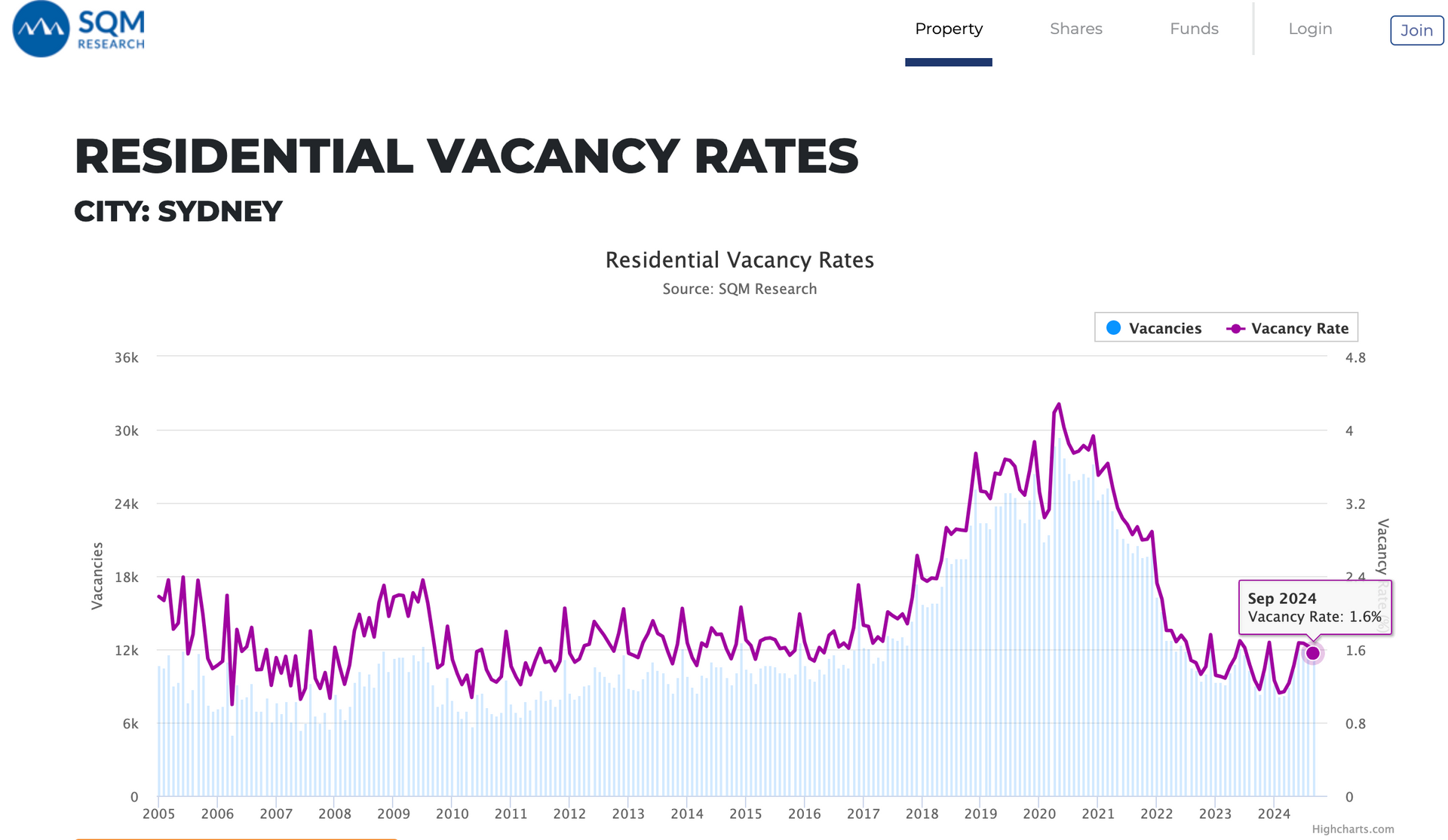

Sydney’s rental market has been challenging for tenants due to limited supply and rising demand. The city’s vacancy rate, traditionally low, dropped to 1.7% in 2024 according to SQM Research, far below the balanced market rate of 2-2.5%. This shortage has resulted in higher rents and intense competition for available properties, placing further strain on the market.

The low rate of new dwelling approvals compounds this crisis. In June 2024, ABS reported a 19% decline in NSW dwelling approvals, the lowest level since 2013. This lack of supply is especially concerning given Sydney’s population growth, driven by immigration and returning residents. The state’s population grows by over 15,000 people each month, with an increasing number requiring rental properties.

As the demand for rental properties continues to outstrip supply, Sydney’s rental market is under severe pressure. Property investors stand to benefit from these conditions, as rents are likely to rise and vacancy rates remain low. However, the high demand and low supply make acting quickly essential, especially for investors looking to maximise returns in the near future.

Long-Term Infrastructure and Government Reforms

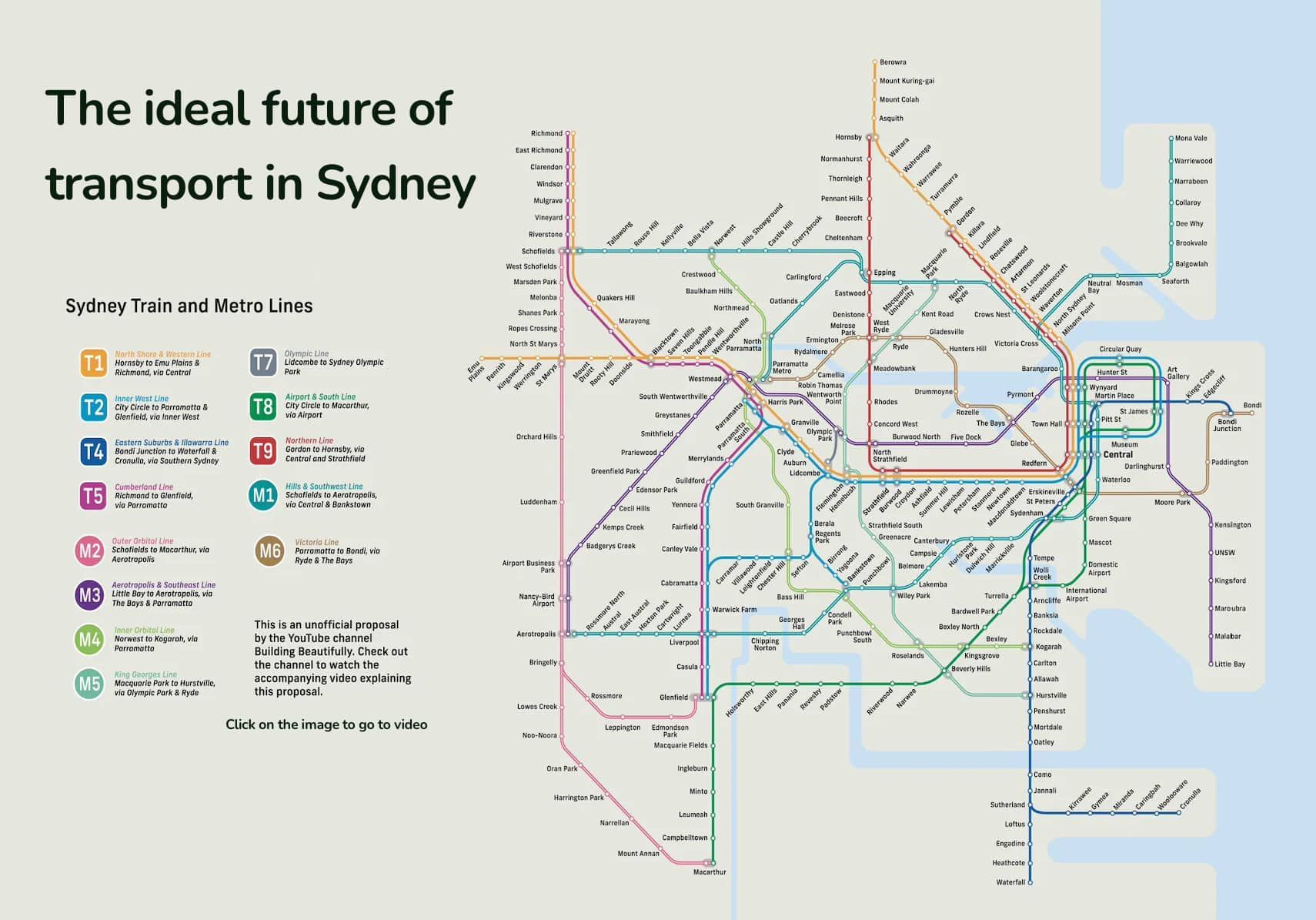

Looking ahead, various infrastructure projects are expected to influence Sydney’s property market. Major transportation upgrades and urban renewal projects promise to enhance accessibility and increase the appeal of emerging suburbs. However, government intervention in the form of property tax reforms and rental policies could significantly impact market dynamics.

REINSW CEO Tim McKibbin emphasised that high taxation, approval delays, and anti-landlord reforms contribute to the housing shortage. With investor sentiment already strained, these factors only worsen Sydney’s housing crisis, reducing rental supply and making it harder for tenants to secure affordable housing.

For the market to stabilise, reforms that support property investors and accelerate housing developments are essential. However, the timeline for such changes remains uncertain, making it all the more crucial for investors to act now rather than wait.

How PB Property Can Help You Navigate Sydney’s 2025 Market

The Sydney property market’s potential for growth makes this an ideal time to invest. Whether you’re a first-time investor or a seasoned property owner, PB Property’s experienced team can provide the insights and support needed to make strategic decisions in a competitive market. Here’s how we can help:

- Expert Market Analysis: Our team offers in-depth analysis of the Sydney property market, helping you identify high-potential areas and property types that align with your investment goals.

- Customised Investment Strategy: Based on your financial objectives, we craft a tailored strategy to maximise returns and minimise risks in an evolving market.

- Comprehensive Property Management: From tenant selection to maintenance, PB Property’s property management services ensure your investment is well-maintained, keeping vacancy rates low and rental yields high.

- On-the-Ground Insights: As local market experts, we provide the latest data and trends, giving you a competitive edge in Sydney’s dynamic property landscape.

Don’t Wait—Secure Your Future in Sydney’s Thriving Property Market Today

The window of opportunity to secure high-growth properties in Sydney’s market is open, but not for long.

As population growth continues and property supply remains limited, prices are set to climb. Whether you’re considering a family home in a premium suburb, a townhouse in a middle-ring area, or a boutique apartment in a lifestyle hub, now is the time to act. Speak to PB Property today to get started with a strategic investment plan that positions you for success in Sydney’s 2025 property market.

share to