As 2025 approaches, Sydney’s property market is generating a mix of enthusiasm and cautious optimism. Both ANZ and Oxford Economics have released data-driven forecasts that shed light on potential growth patterns, investment opportunities, and challenges in the year ahead.

This analysis also revisits why waiting for the “right time” to buy may come with its own risks, particularly given Sydney’s resilient property growth. Let’s delve into expert predictions, suburb performance, and the impact of critical infrastructure projects, setting the stage for a nuanced understanding of Sydney’s market trends in 2025.

Key Drivers Shaping Sydney’s 2025 Market

Sydney’s property market continues to navigate complex dynamics, balancing strong demand, high interest rates, and affordability challenges. Despite these factors, the city's housing shortage, buoyant immigration rates, and substantial infrastructure investments are projected to sustain upward trends in property values through 2025.

1. Housing Shortage and Limited Supply

- A shortage of dwellings remains one of Sydney’s most pressing challenges. New dwelling approvals, which were already low, fell by 19% in 2024 according to the Australian Bureau of Statistics (ABS). This limited supply exacerbates competition, keeping vacancy rates historically low and pushing property values and rental prices higher.

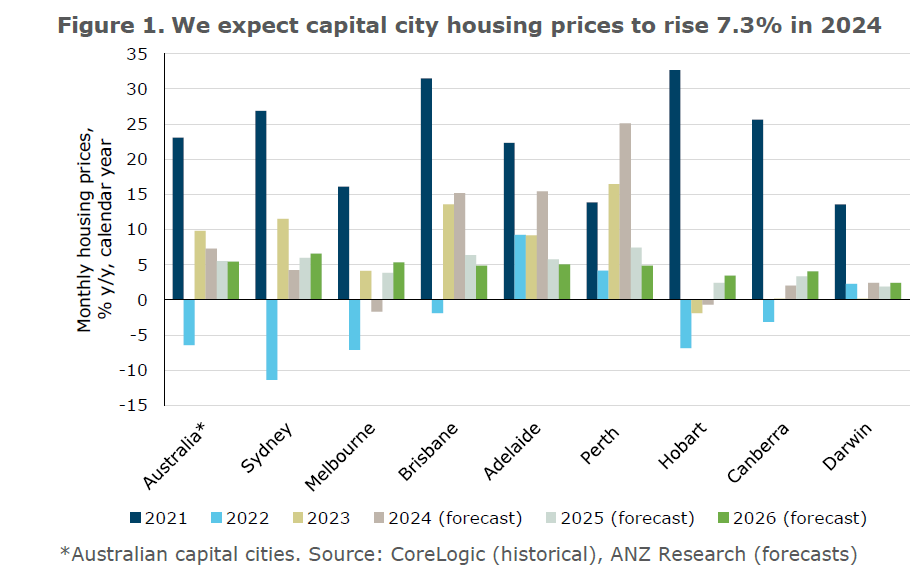

- ANZ Bank’s updated forecast aligns with this observation, suggesting that property values in Sydney may climb an additional 5% in 2025 as limited supply encounters sustained demand.

2. Population Growth and Increased Demand

- With international borders reopened and immigration numbers rebounding, Sydney’s population growth fuels demand across both rental and ownership markets. The ABS reported a 2.1% population increase for Sydney in 2023, and many of these new residents are expected to enter the property market.

- Skilled migrants and international students are significant contributors to this population surge, adding pressure to housing availability, particularly for rentals.

3. Strong Demand for Investment-Grade Properties

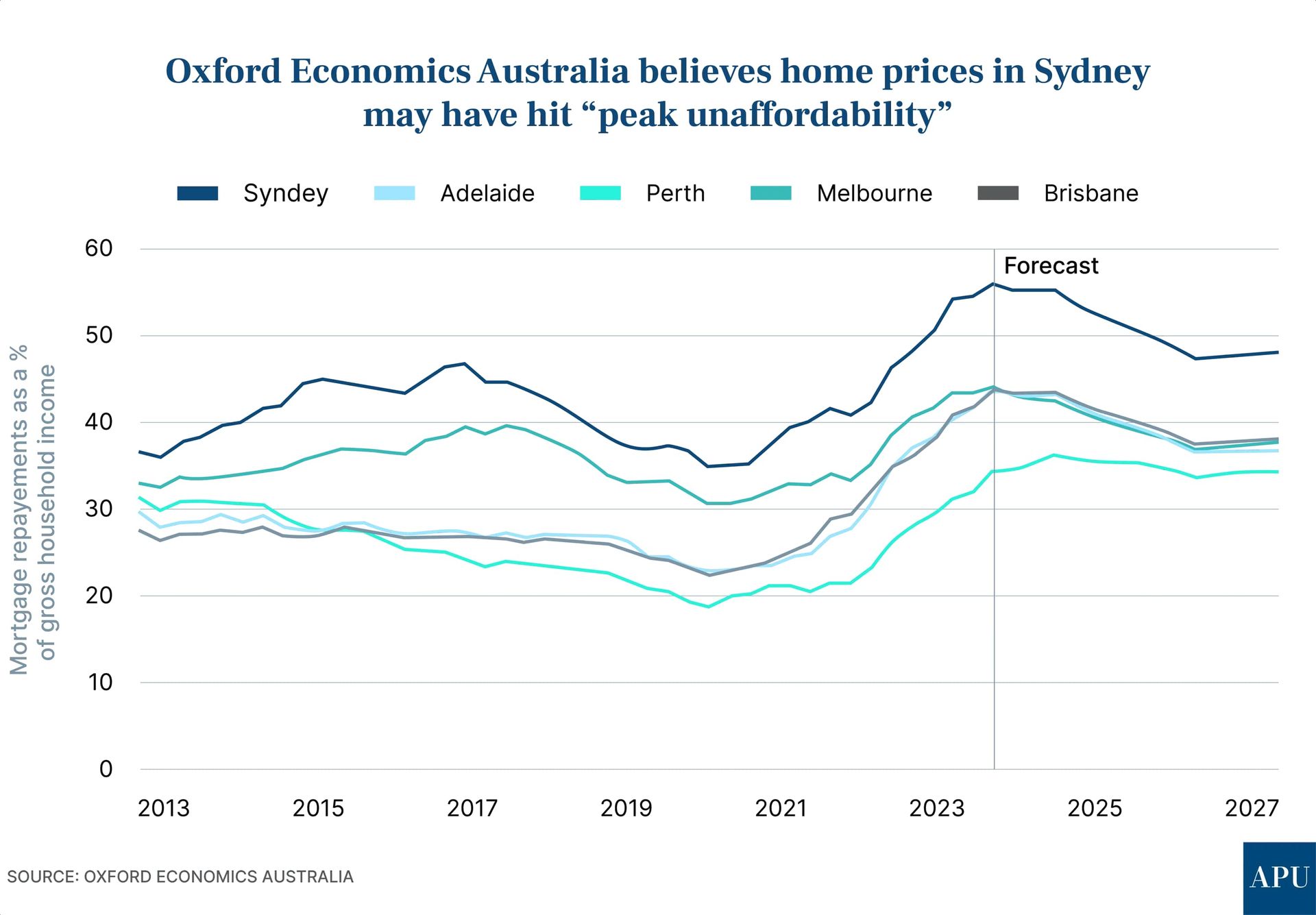

- High-income suburbs, where residents typically have substantial equity, are expected to outperform less affluent areas. Oxford Economics predicts affluent regions, where buyer confidence is higher, will likely drive Sydney's market in the medium term.

Suburb-Specific Forecasts and the “Flight to Quality” Trend

Sydney’s property market remains segmented, with distinct performance variations across different suburbs. Properties in high-demand areas benefit from location, lifestyle amenities, and infrastructure developments that often translate into increased long-term value. Several key trends and areas offer insights for investors:

High-Growth Suburbs in the Inner Circle

- Eastern Suburbs: Known for their coastal appeal and top-tier schools, suburbs like Bondi, Coogee, and Bellevue Hill have consistently performed well. Bellevue Hill and Vaucluse, in particular, saw significant price growth, with average increases over one million dollars in 2023 alone.

- Lower North Shore: With family-friendly amenities and excellent schools, suburbs like Mosman, Lane Cove, and Artarmon continue to attract high demand.

- Inner West: Suburbs like Marrickville and Dulwich Hill are popular among young professionals, with growing restaurant scenes and cultural amenities.

The Middle-Ring Suburbs: Gentrification and Townhouse Appeal

- Northern Beaches and Northwest Growth Corridor: Areas like Dee Why and Castle Hill are gaining traction with families seeking larger living spaces without sacrificing proximity to Sydney’s urban core.

- St. George Area: Kogarah and Hurstville offer residents a balance of affordability and access to Sydney’s CBD and airport, making them ideal locations for investors targeting younger, commuting professionals.

Oxford Economics predicts that these middle-ring suburbs are likely to see increased demand due to affordability pressures in the inner ring, which in turn pushes more people toward gentrifying areas.

Infrastructure Projects: Transforming Sydney’s Property Landscape

Key infrastructure projects underway are anticipated to impact housing demand and property values in specific Sydney suburbs. New transport links, retail precincts, and healthcare facilities enhance access and amenities, making properties near these projects more desirable.

1. Transport Upgrades: Metro Expansion and Western Sydney Airport

- The Sydney Metro expansion will increase accessibility, particularly in the northwest and southwest regions, connecting more suburbs with the CBD. For example, suburbs around Rouse Hill and Kellyville, once considered far-flung, are seeing increased buyer interest due to this improved accessibility.

- The upcoming Western Sydney Airport is expected to boost surrounding property markets, particularly in suburbs like Liverpool and Penrith. The airport will attract new businesses and amenities, transforming Western Sydney into a commercial and logistics hub.

2. Healthcare and Retail Developments

- New hospitals and retail precincts, such as the Nepean Hospital redevelopment and the planned business parks in areas like Marsden Park, add to the attractiveness of suburbs in the western and northwestern corridors.

Investing in these areas offers the dual benefit of price appreciation driven by infrastructure growth and sustained demand from local residents and businesses.

The Case for Units: Affordability and Forecasted Growth

In light of high property prices, units present a relatively affordable entry point into Sydney’s property market. Oxford Economics Australia predicts that units are set to outperform houses in capital growth, with an anticipated 5.1% rise in median unit prices in 2024 and an annualised 6.7% growth from 2025 through 2027. Units in inner and middle-ring suburbs with easy access to the CBD, universities, and lifestyle hubs are especially attractive for investors and first-time buyers.

ANZ and Oxford Predictions: Navigating Sydney’s 2025 Market

With multiple forecasts from ANZ and Oxford Economics pointing towards growth, the window for securing a property at current rates may be closing. Let’s consider how these predictions shape investment decisions:

1. ANZ Bank’s 2025 Outlook

- ANZ predicts Sydney’s property values will rise by approximately 5% in 2025. Their analysis suggests that as inflation stabilises and consumer confidence improves, both buyer and seller activity will pick up.

- ANZ also highlights a “flight to quality,” suggesting that investment-grade properties in established suburbs will outperform lower-grade properties.

2. Oxford Economics: Units to Outperform Houses

- Oxford forecasts a 4.7% growth for capital city median house prices and a stronger 5.1% for units in 2024. The firm expects this growth to accelerate further, especially for units, with a projected 6.7% annual average growth until 2027.

- This trend underscores the potential value of units as an investment option, especially for those targeting Sydney’s affordability-constrained market.

Oxford also anticipates a shift in rental market dynamics, predicting that the rapid rental growth observed over the past 18 months will slow. For investors, this implies that although rental yields may moderate, units with high tenant demand will remain stable.

Strategic Suburb Selection for 2025: Where to Focus

In choosing a suburb to invest in, look for those benefitting from major infrastructure projects or demographic shifts:

- Suburbs with Transport Links and Infrastructure Projects: Liverpool and Penrith near the upcoming Western Sydney Airport, or Marsden Park and Rouse Hill due to metro expansions.

- Gentrifying Areas with Lifestyle Amenities: Inner West suburbs like Dulwich Hill and Marrickville, as well as emerging areas in the northern beaches and St. George area, offer great potential for capital growth as cafes, parks, and dining options attract young professionals.

- High-Population Growth Suburbs: Suburbs where population growth is driven by young families and immigrants, particularly those close to schools, employment hubs, and transport, will see high demand.

Key Trends Shaping Sydney’s Property Market in 2025

- Migration-Driven Population Growth: Increasing immigration rates are expected to drive demand for properties, particularly in rental markets.

- Ongoing Housing Shortage: With low vacancy rates and high demand, both property values and rents are expected to climb.

- Infrastructure-Driven Growth: Suburbs connected by transport projects and near new healthcare facilities are primed for value increases.

- Affordability and Units: Rising house prices will push more buyers toward units, with potential for strong capital gains in lifestyle-focused and accessible suburbs.

Buy now or wait? Here is a full pros and cons list.

share to