The Brisbane property market continues to be one of Australia's strongest, even as we approach the final stretch of 2024. After experiencing a meteoric rise of 64% in housing prices since the pandemic began, Brisbane has cemented its position as one of the top-performing capital city markets in the country. This incredible growth has pushed the median home value above that of Melbourne, reflecting Brisbane's increasing attractiveness as a lifestyle and investment destination. The big question for many is: what lies ahead, and how can you take advantage of the opportunities Brisbane offers?

In this article, we will explore the key trends shaping Brisbane’s property market, the factors driving its continued growth, and why now might be the perfect time to speak to PB Property about getting into the market. With major infrastructure projects on the horizon and a booming population, Brisbane is primed for further growth—don’t miss out on the opportunities available.

Brisbane's Resilience in 2024

Despite the broader economic challenges, Brisbane’s property market has shown remarkable resilience. As we approach the end of 2024, dwelling values continue to climb, with the city's housing market maintaining its strong momentum. A combination of factors is at play, including a slowdown in new construction, growing demand for existing properties, and interstate migration driving up buyer activity.

One of the key trends we’ve seen this year is the strong performance of lower-priced properties. Brisbane's more affordable homes, particularly those in the bottom quartile, have recorded price growth of around 30% higher than their 2022 peak. This is an encouraging sign for first-time buyers and investors looking for affordable entry points into the market.

Looking forward, the outlook remains positive. While affordability will remain a challenge for many buyers, potential interest rate cuts could improve borrowing capacity, leading to increased buyer confidence and heightened activity in 2025. This means that if you’re considering entering the market, now might be the perfect time before competition ramps up even further.

Why Affluent and Gentrifying Suburbs Will Lead the Way

While Brisbane offers opportunities across its property market, it’s crucial to be strategic about where you invest. As affordability becomes a more significant factor, it’s likely that affluent inner-ring and gentrifying middle-ring suburbs will outperform cheaper areas where residents may struggle with purchasing power. Investing in suburbs where wage growth outpaces inflation and where residents have multiple income streams will ensure that your investment remains in demand.

Inner-city suburbs like Paddington, Ashgrove, and Red Hill are poised for strong performance thanks to their proximity to the CBD, heritage charm, and thriving café culture. Similarly, western suburbs such as Indooroopilly, Chapel Hill, and Kenmore offer excellent schools and family-friendly environments, making them popular choices among families and professionals.

If you're looking for more affordable options, areas like Stafford, Kedron, Wavell Heights, and Cannon Hill offer great potential for capital growth. These suburbs are benefiting from infrastructure improvements and gentrification, positioning them for strong demand over the coming years.

Townhouses: The Affordable Alternative

As Brisbane’s property market continues to evolve, medium-density housing like townhouses is becoming increasingly popular. Townhouses provide a cost-effective alternative to standalone houses, offering more space than apartments without the premium price tag. This makes them an attractive option for young families, professionals, and downsizers alike.

Areas such as South Brisbane, Greenslopes, Carina, and Camp Hill are ideal for townhouse investments. With ongoing urban renewal projects, new infrastructure, and proximity to key amenities, these suburbs offer solid rental yields and long-term capital growth potential.

Townhouses in northern suburbs like Stafford and Kedron are also becoming highly sought after due to their access to public transport, proximity to shopping centres, and ease of commuting to Brisbane Airport. This emerging hotspot offers excellent opportunities for investors looking for affordable yet promising investment properties.

Apartments in Boutique Complexes

While high-rise apartments may not be the best option for investment, boutique apartments in well-located suburbs present a fantastic opportunity. These smaller complexes cater to a specific market of renters and owner-occupiers who value lifestyle over space, making them a sound long-term investment.

Suburbs like New Farm, Teneriffe, and West End continue to see strong demand from young professionals and downsizers, thanks to their vibrant café cultures, riverside views, and proximity to the CBD. Similarly, areas like Albion and Wooloowin are undergoing significant gentrification, making boutique apartments in these suburbs an affordable entry point with long-term growth potential.

The Impact of Major Infrastructure Projects

One of the key drivers of Brisbane’s property market growth is the city’s ongoing infrastructure boom. Major projects such as Cross River Rail, Brisbane Metro, and the preparations for the 2032 Olympics are transforming the city. These developments are not only improving accessibility and livability but also creating jobs and boosting economic activity.

Suburbs that benefit from these infrastructure upgrades are likely to see increased demand, making them attractive targets for property investors. With billions of dollars pouring into Brisbane's infrastructure, the property market is set to experience significant uplift over the next decade, providing an incredible opportunity for those who invest early.

Population Growth and Migration

Another key factor underpinning Brisbane’s property market growth is the city’s rapidly growing population. Queensland recorded a population growth rate of 2.6% in the 12 months leading up to June 2023, driven by a surge in interstate migration from states like Victoria and New South Wales. As more people flock to Brisbane in search of better affordability, job opportunities, and a higher quality of life, demand for housing is only expected to increase.

In fact, government forecasts predict that Queensland’s population will grow by more than 16% by the time Brisbane hosts the Olympic Games in 2032. This population boom, combined with Brisbane’s expanding economy, ensures that the property market will continue to thrive well into the future.

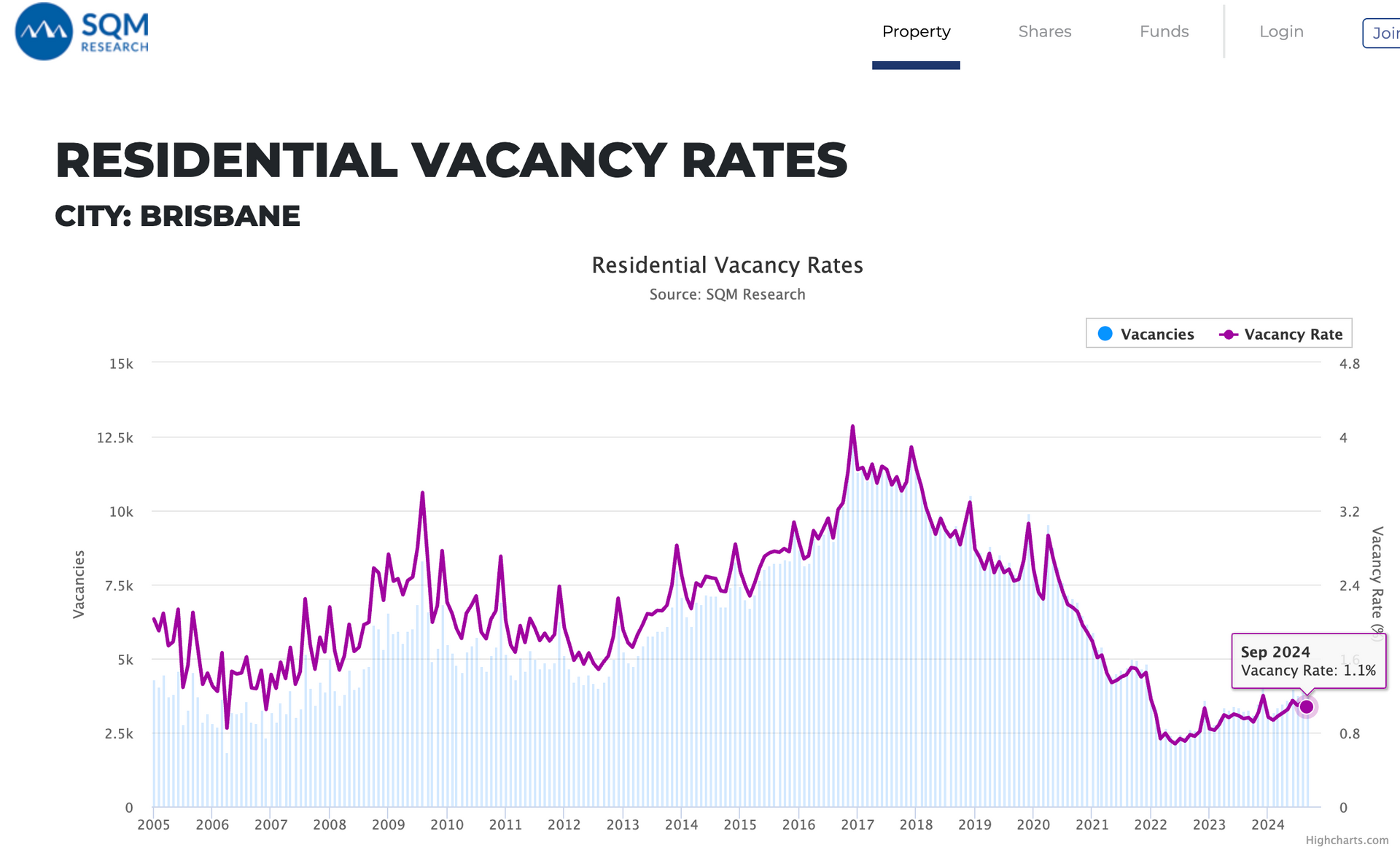

Brisbane’s Tight Rental Market

Like much of Australia, Brisbane’s rental market is in crisis. With vacancy rates for houses sitting at just 0.9% and 1.0% for units, it’s a landlord’s market. Rents have risen by 9.3% for houses and a staggering 24.8% for units over the past year, further adding to the pressure on tenants. This low vacancy rate, coupled with increasing demand, means that investing in Brisbane’s rental market can offer attractive returns.

For investors, now is the time to act. With rental demand outstripping supply and Brisbane’s population continuing to grow, securing an investment property in the right location could yield substantial rental income in the years to come.

What Should Investors Do Now?

If you're considering investing in the Brisbane property market, now is the time to act. With strong population growth, major infrastructure projects, and tightening supply, Brisbane’s property market is set for continued growth throughout 2025 and beyond. However, competition is also increasing, and the best properties in prime locations are likely to be snapped up quickly.

This is where PB Property can help. Our team of experts is here to guide you through the process, helping you find the right investment property that matches your goals and financial situation. Whether you're looking for a house in a lifestyle suburb, a townhouse in an emerging hotspot, or a boutique apartment in the inner city, we have the knowledge and experience to help you succeed.

Key Takeaways

- Brisbane’s property market continues to be one of Australia’s strongest, with dwelling values reaching new highs.

- Infrastructure projects and interstate migration are driving demand, making Brisbane a prime location for property investment.

- Affluent inner-ring and gentrifying middle-ring suburbs are likely to outperform cheaper suburbs.

- Townhouses and boutique apartments offer affordable alternatives to houses with solid growth potential.

- Brisbane’s rental market remains tight, offering attractive returns for investors.

- Now is the time to act—speak to PB Property today to find the perfect investment property and secure your place in Brisbane’s booming property market.

share to