Not enough housing

In this blog I’d like to clarify some numbers that most people don’t take into consideration when purchasing an investment property in Australia.

Population Growth vs Property Pipeline

The reason why people forget is because they only think on the present moment and forget that Property is a long term game. A typical example is NOW.

Australia is currently shut to the world and overseas migration because of COVID-19 and people forget that eventually the borders will reopen and when that happens all the properties that are currently empty will be filled up.

Especially when we look at the apartment market, as most people that migrate to Australia for the first time end up in big Capital Cities like Sydney and Melbourne, they don’t know anywhere else than the CBD and want to stay close to the their employment or to what for them feels safe.

Most of the CBDs are high density, what means that they will end up in an apartment block.

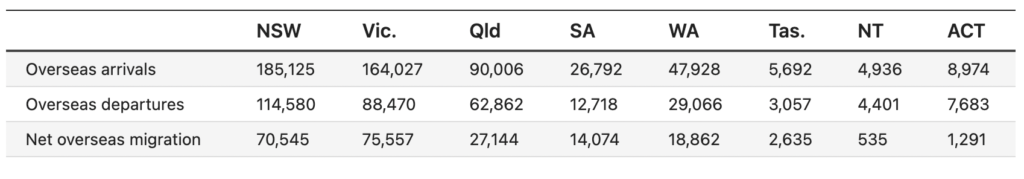

Up to December 2019, Australia was receiving around 349,800 people a year and more that 50% of this number was being absorbed by New South Wales and Victoria. Source ABS

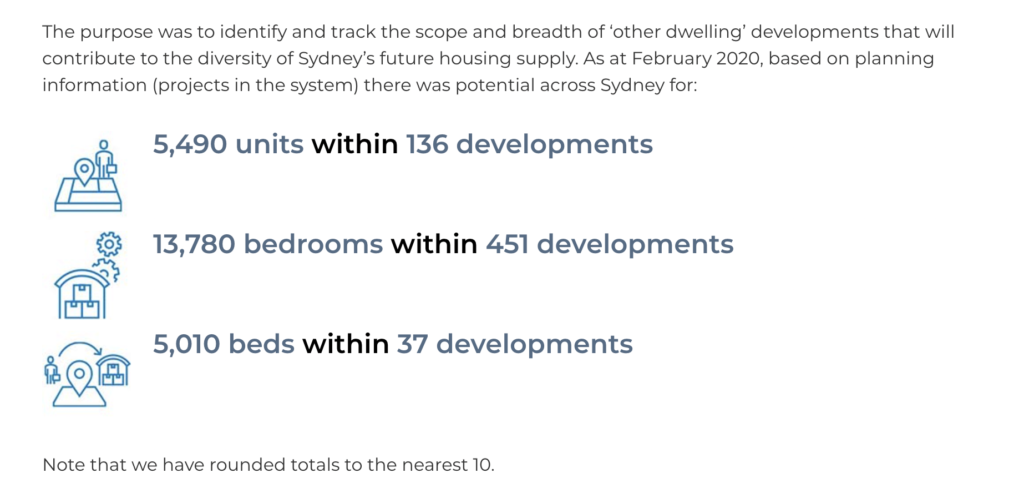

One of the big concerns that are being raised all over the media is the shortage of pipeline supply especially for the apartment market.

Many may not agree and prefer to live in a house either then an apartment but we all understand that land is scarce and it’s easier to create more housing going up than going sideways.

This is where investor activity is so important, as the Government is not able to provide housing to everyone it relays on investors to keep building residential infrastructure.

Duo to Covid and an impressive pipeline of Government infrastructure that has been boosting the Australian Economy we are seeing a massive decrease of new apartment projects being approved what causes developer to back down as construction becomes more expensive when completing for materials in this space.

The numbers we are seeing at moment are as low as 86,400 new apartments are tipped to be in the pipeline by 2024, compared with 135,300 from 2018-2020;

What will happen once our borders reopen?

All the stock that is currently empty will be filled up.

If you just stop and look at those numbers and compare the numbers of overseas migration with the numbers of stock pipeline we will be experiencing serious shortages in our housing market, what will create a big competition in the rental space.

As a property investor it’s important to look at the holistic picture and understand that when planning long term is always the way to go for your investment strategy.

Interest to talk? Book a Chat with me.

share to