Property prices keep going up

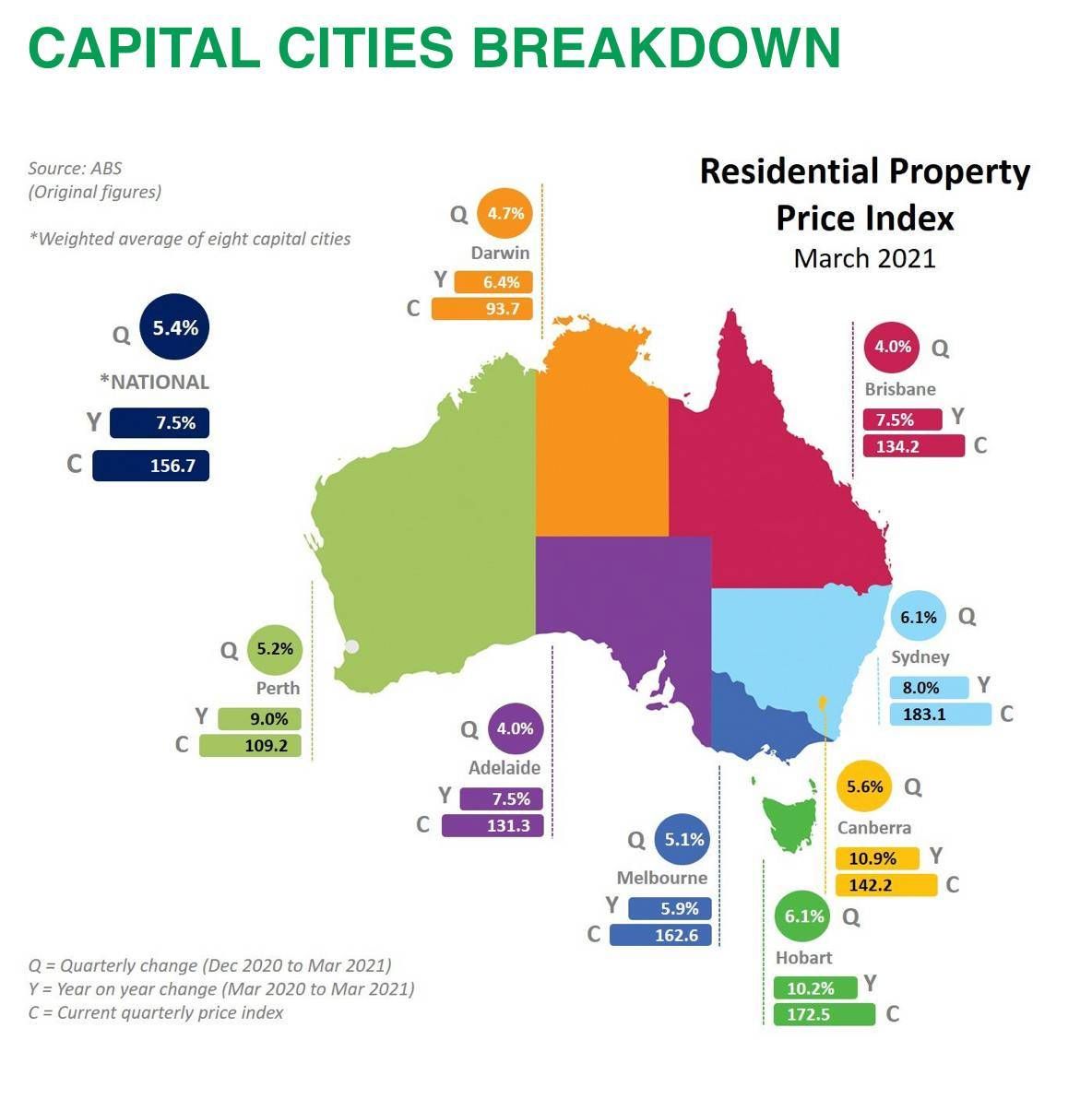

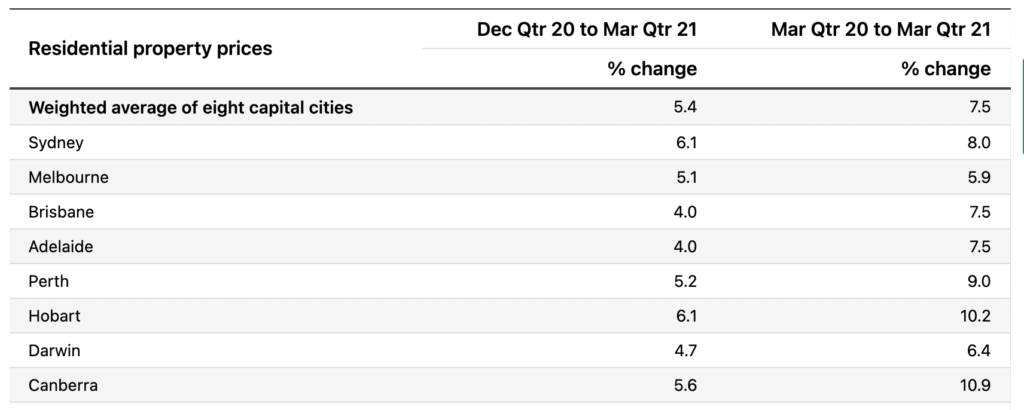

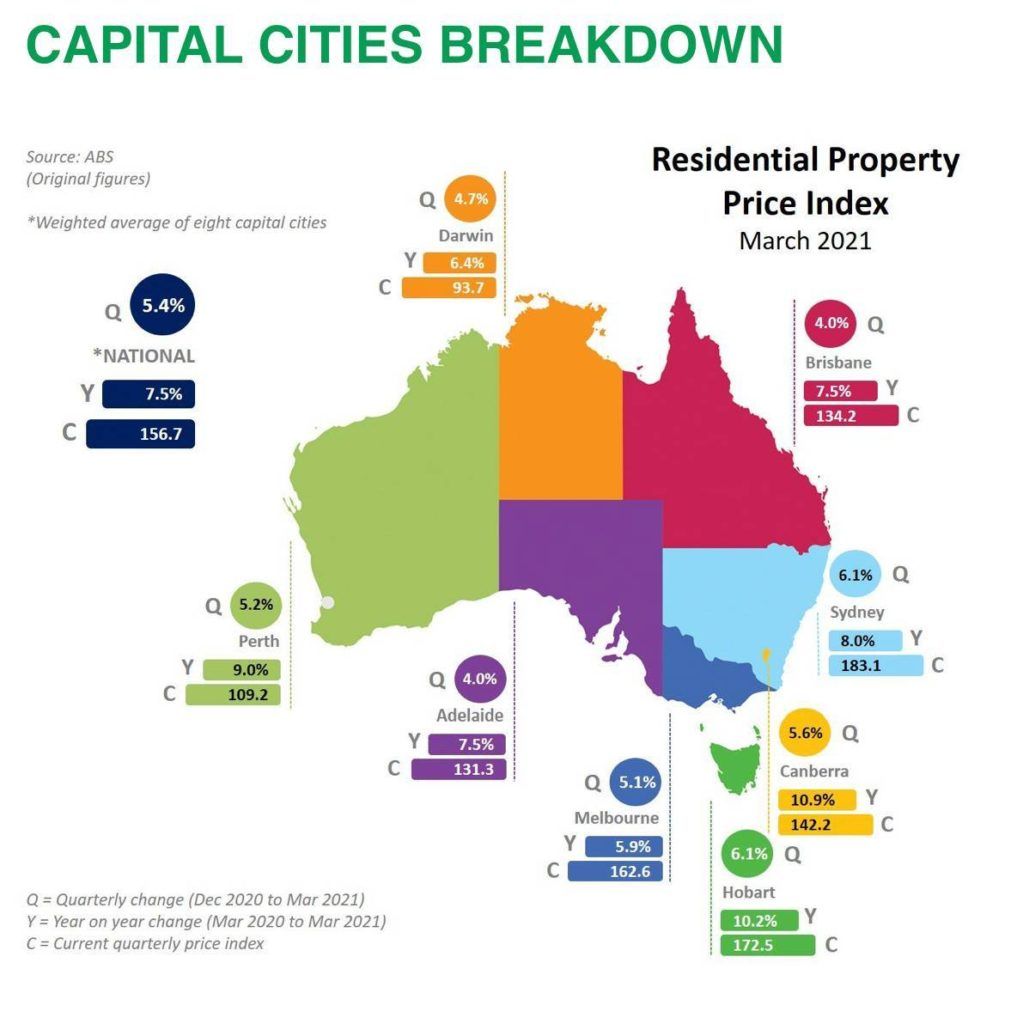

It’s very rare when all capital cities experience property rise in prices and as shown in ABS data for the March quarter, that’s exactly what’s happening!

Yep, your read correctly! March quarter. Only today the ABS released the numbers. Overall the total value of residential dwellings in Australia rose $449.9b to $8,293.2b this quarter.

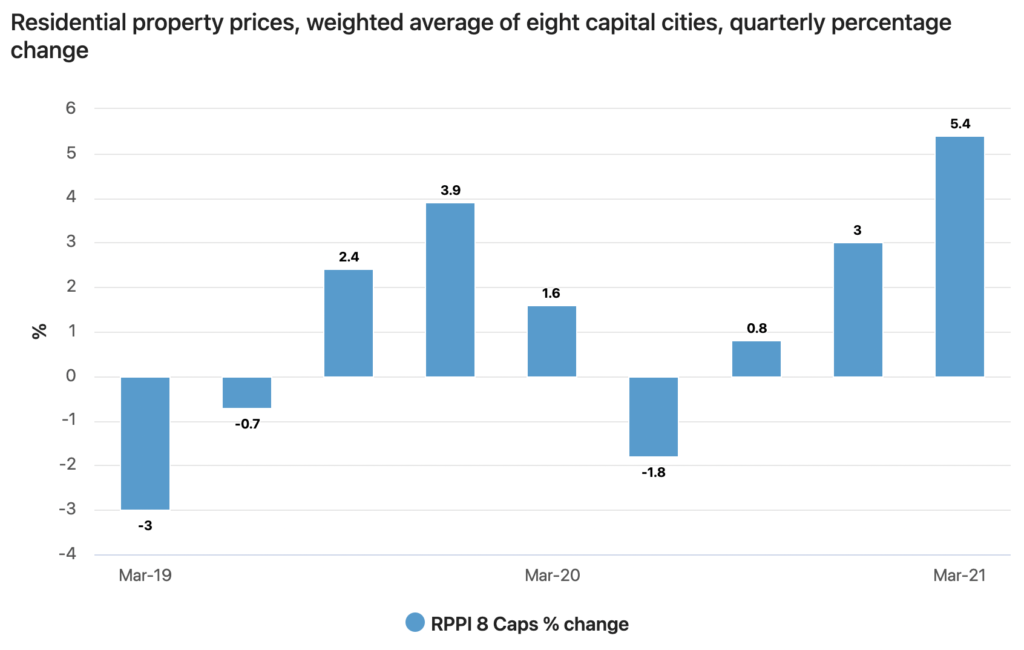

It was the stronger quarter growth registered since December 2009.

This results were backed up by the high demand associated to the current super low interest rates, support from the government with all the additional incentives what translated into higher consumer confidence.

You can download CoreLogic full report here.

The quarterly change residential property price index national weighted average was of 5.4%

The number of residential dwellings rose by 44,300 to 10,645,400, and the mean price of residential dwellings rose $39,100 to $779,000 this quarter.

The value of residential dwellings in NSW this quarter was $3,330.5 billion, NSW accounted for approximately 40 per cent of the total value of dwellings in Australia.

Prices have continued to rise since the quarter mentioned here making the Australian Property Market one of the Hottest in the world.

Data is one of the most important tools a property investor or property lover has in their hands to be able to make informed decisions when buying next.

I'd love to help you navigate or answer and questions you may have. Just book a chat with me.

share to