Even with the 3 year lag the undersupply situation will hit hard

Many of the factors that drive the short-term or long-term price of residential property have been impacted by the onset of the global coronavirus pandemic.

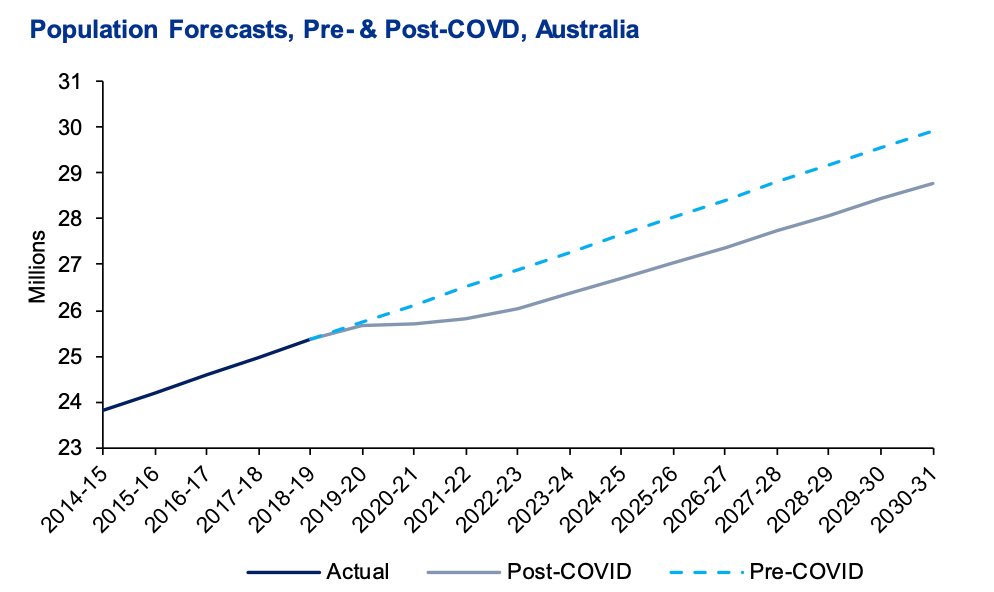

Australia’s population is now anticipated to be lower by about 1 million people by the end of this decade compared to the pre-pandemic forecasts.

This reduced population growth will feed into the property market through a combination of ways, including reducing the immediate demand pressures for accommodation as Australia’s border remain shut to both returning travellers and foreign migrants.

The longer the borders remain shut the larger the impact will be on Australia’s population due to the cumulative impact of fewer new migrants settling in Australia and loss of subsequent natural population increase from these new migrants.

The Commonwealth Government and the Reserve Bank of Australia (RBA) have implemented a range of policy responses to deal with the economic impacts of the coronavirus pandemic.

These policy responses have included direct support to the residential construction sector through the HomeBuilder program and more broadly to the economy as a whole through the adoption of highly accommodative monetary policy settings.

It is instructive to estimate the path residential property prices would have taken if the pandemic had not occurred.

We are able to do this with our models by using pre-pandemic inputs.

With pre-pandemic projections of the inputs we can use KPMG’s models to estimate for each capital city ‘counterfactual’ price paths for houses and units. These counterfactual price paths are our best estimate of what would have happened to house prices in the absence of the COVID-19 pandemic.

Long run property prices

Real house prices in the long run are heavily conditioned by two key factors; how many households need to be accommodated (demand) and how many properties exist to accommodate them (supply).

Both of these factors have been materially impacted by the onset of the coronavirus, and to some extent by the economic policy responses by government.

Population

COVID-19 border closures and travel restrictions are having a significant impact on migration and thereby population projections.

Estimates of future population are inherently uncertain, and future estimates are more variable given the increased instability associated with COVID-19.

The Centre of Population released a Population Statement for Australia in early December 2020 with COVID-19 population projections out to June 2030.

According to the Population Statement released by the Australian Government, Australia's population is projected to increase from 25.36 million at June 2019 to reach 28.43 million by June 2030, or 1.11 million less than it could have otherwise been without COVID-19.

KPMG’s report Pathways to recovery: International students will boost our living standards projected Australia’s population could be in the order of 1.08 million less than it could have been without COVID-19 by June 2030, which is broadly consistent with the projections released in December 2020.

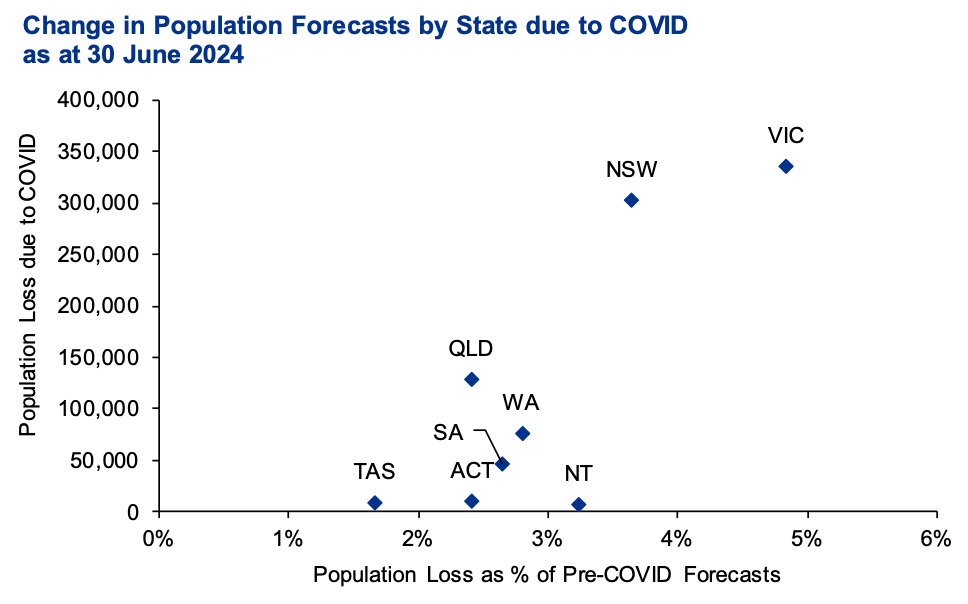

The population projections also reveal the expected impact will not be uniform across different states and territories, with Victoria anticipated to suffer the greatest effect on its population growth, with Tasmania the least impacted.

Dwelling Supply

Australia’s stock of dwellings change over time as our population changes and demographic factors, including family composition and age, influence the type of dwellings in demand.

The number and type of dwellings used to accommodate our population are counted during each 5-yearly Census conducted by the Australia Bureau of Statistics.

At points in time between these 5 year intervals it is difficult to accurately estimate the stock of dwellings.

Simply adding housing completions to the Census housing population values does not take into consideration the fact that developments can occur on greenfield and brownfield sites, meaning existing dwellings are occasionally demolished to make way for new properties.

For example, KPMG has previously found that for every ten dwellings constructed the stock of dwellings increase by nine.

For this study we have completed a more detailed analysis for each capital city of the relationship between population and dwelling approvals, as well as dwelling approvals and dwelling completions (both in terms of completion rates and the time lag between receipt of a building approval and delivery of an occupancy-ready dwelling).

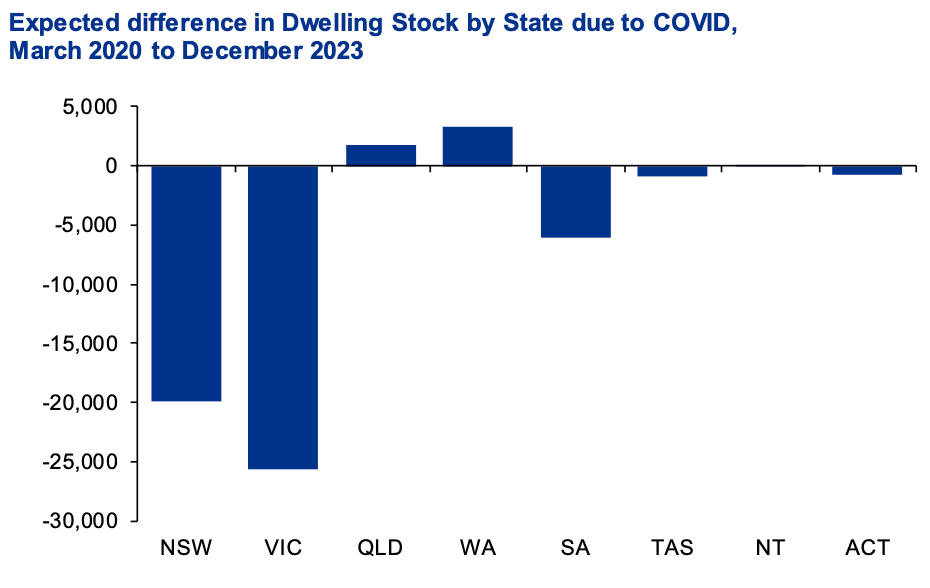

The key findings of this analysis are summarised in the following chart, which shows that during the four years from the start of 2020 to the end of 2023 the stocks of houses and units in Victoria and New South Wales are expected be around 25,000 and 20,000 lower respectively than would have been the case in the absence of the COVID-19 pandemic.

Interestingly, Queensland and Western Australia are likely to see slightly higher dwelling stocks due to a range of factors, including positive net interstate migration.

Short run property prices

Real property prices in the short run are influenced by a range of factors that can have positive and negative impacts of varying magnitudes.

KPMG’s analysis identified a range of short run factors that influence real dwelling prices, including:

• momentum, by growth in real dwelling prices in the previous period

• dwelling prices in other markets

• the magnitude of the gap between the actual price and the estimated long run equilibrium price • real mortgage interest rates

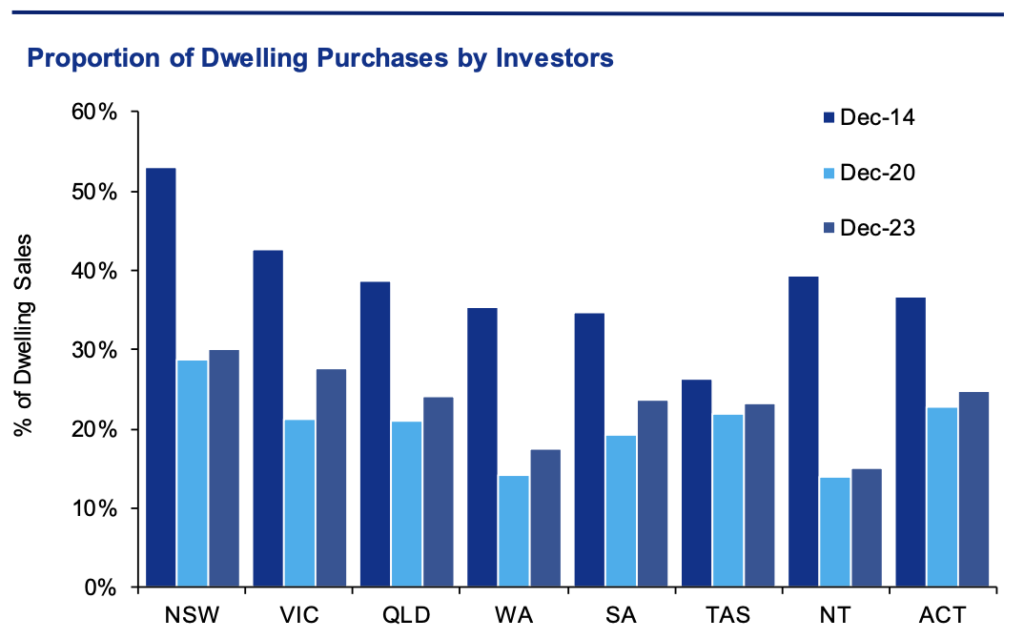

• the share of dwellings purchased by investors

• the existence of macroprudential controls.

In the context of this modelling analysis only real mortgage interest rates and the level of investor participation are not determined within the model (endogenously).

Projections for these variables must be determined externally (exogenously).

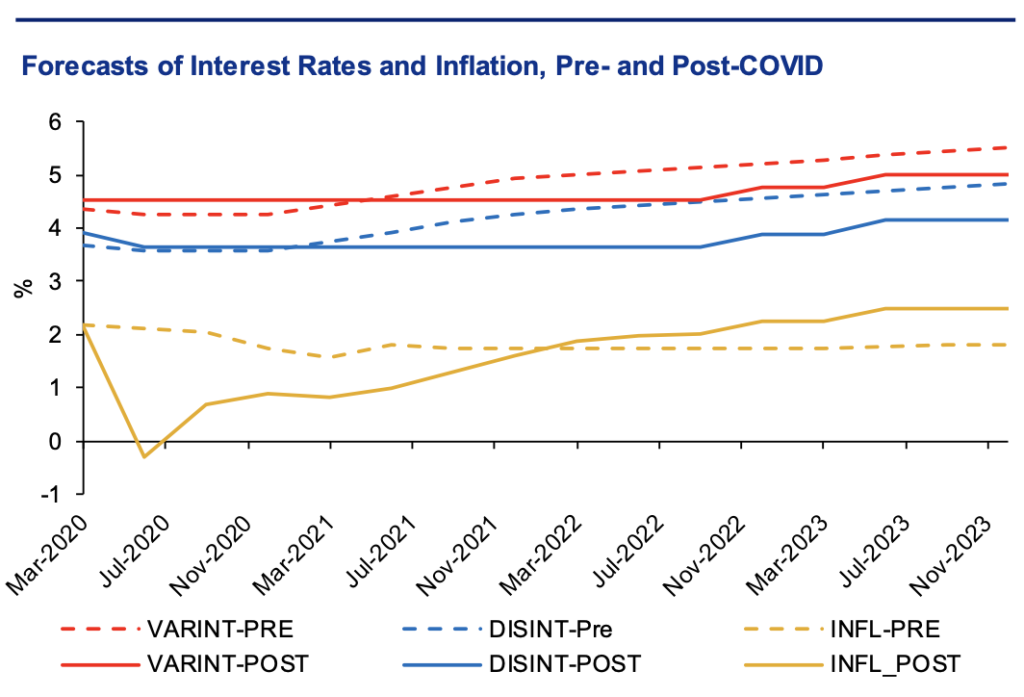

Projections for variable mortgage interest rates (VARINT), discounted variable mortgage interest rates (DISINT), and inflation (INFL) were obtained from KPMG’s macroeconomic forecasts completed in December 2019 (Pre-COVID-19) and in March 2021 (Post-COVID-19).

As shown in the chart below KPMG’s March 2021 projections have mortgage lending rates trending upwards from the middle of 2022 in line with higher wholesale borrowing costs faced by the banking sector in Australia.

Also, we are anticipating inflation to rise and be at the lower end of the RBA Target Band from the middle of 2022 as well.

In terms of investor participation in the dwelling market we have maintained the same assumptions between the Pre-COVID-19 and Post-COVID-19 scenarios on the basis of the assumption that the risk profile of investing in property relative to other asset classes has not changed as a consequence of the pandemic.

If you wish to read the full report download it here.

Want to chat about property? Book a time.

Interested in some great projects?

share to