Do we really know the truth about who wins?

Australia property market is very dynamic and constantly changing however people have some preconceptions about Apartments vs Houses when comes to investing in property.

Many believe that Apartments are a terrible investment and houses are the way to go.

Having personally invested in both I thought I share with you a list of pros and cons about both so you can make your own conclusions.

Buying a House as an investment

Cons

1. Price

Houses are often more expensive to buy than apartments and units in the same area. This can be a discouraging for some buyers, including first-time property investors or anyone looking to diversify their investment portfolio.

2. Lower rental yield

Rental yield expresses the amount of money you make on an investment property, compared to its purchase price, as a percentage. It’s a valuable tool for calculating your return on investment.

As a rule of thumb, houses can have a lower rental yield than apartments and units, even though they usually have greater capital growth.

So, a house might not be the best option if you need rental income for cash flow.

3. Maintenance costs and upkeep

When it comes to houses, you have to pay all of the maintenance and upkeep fees, as well as insurance premiums for the building itself, if you choose to take out a policy. You should ensure the home is structurally sound, including getting a thorough building inspection prior to purchase.

Pros

1. Higher capital growth

Houses usually offer greater long-term capital growth than apartments, as land often appreciates over time and houses tend to have more associated land than apartments.

However, it is important to note that this isn’t always the case. For example, a block of land located in the interior of Australia is unlikely to be more valuable than the floor space of a penthouse in Darling Harbour.

That’s why it’s always important to consider location and market conditions when investing.

2. Opportunities to renovate and subdivide

Since you control 100% of the property if you are a sole investor for a house, you can go ahead and make strategic improvements to increase its value.

For example, you may be able to improve your house with renovations or subdivide the land (provided you have Council approval), without needing to request permission from a body corporate or other residents.

3. Consistent rental returns

Houses can attract tenants, such as families and professional couples, who are reliable and want to stay in a certain suburb for schooling or work opportunities long-term.

Tenants who are pet owners may also choose to rent a house due to added flexibility in the lease terms. Body corporate by-laws for apartments, in contrast, can restrict or limit pet ownership (e.g., not allowing prospective tenants or owners to have pets, or setting weight limits on dogs). Research shows pet owners, on average, have a longer tenancy length.

Buying an Apartment as an investment

Apartments are an attractive option for investors as they are usually more affordable than houses. However, there are many factors to consider when buying an apartment.

Cons

1. Lower land value

Apartments and units generally have a much lower proportion of associated land, which means they often don’t offer as much capital growth as houses do regarding the land component.

The long-term return from any property is influenced by many other wider factors too, such as location, comparable sales, market trends, condition and property characteristics. So when you buy an apartment all these factors should be looked at.

2. Maintenance costs and upkeep

You may notice this is listed on pros and cons as it can be considered to be both. While paying ongoing body corporate fees eliminates having to organise and pay for some unplanned repairs, it can also be an expensive ongoing outlay.

This is especially true if the complex includes additional facilities such as a gym, sauna, tennis court and swimming pool. Having said that when the Strata is well managed all those get looked after.

3. Lack of control

Most apartments and units are part of a strata title, so if you want to make any changes or renovations, you need to get permission from the body corporate. This lack of control can put limitations on maximising the value and use of the property. One good tip is to be part of the body corporate.

4. Future developments

The number of apartments and units in an area can increase significantly over several years. If you own an existing apartment or unit in an oversupplied area, you could potentially suffer from lower rental yield, renter demand and capital growth.

Pros

1. Affordable options

Apartments and units can offer an affordable entry point into the market, in areas that may be beyond your budget if you were looking at houses. The lower outlay can also mean fewer risks and more investment choices for you.

2. Supply and demand

Single- and two-person households are generally becoming more common in Australia. Australian Bureau of Statistics (ABS) data projects lone-person households will rise from 25% (2.3 million) to 24–27% (between 3 to 3.5 million) Australian households from 2016 to 2041.

Lone-person households and single parent families with dependent children are more likely to have low-income, and low-wealth households are less likely to own property, according to ABS household income and wealth data.

If smaller Australian households rent, there may be stronger renter demand, higher rental yields and more investment security for some apartment owners in the longer term.

3. Maintenance costs and upkeep

A big advantage of owning an apartment or unit is that everyone in the building or complex shares the cost of insurance, maintenance and upkeep in the form of a strata title.

An owners corporation, also known as a body corporate, manages and maintains the common areas of a strata-titled property.

Paying annual fees and special fees (also known as special levies) such as body corporate fees may make your property easier to manage.

4. Potential for multiple assets

Depending on your budget, you could potentially buy two apartments or units for the same price as one house.

This could provide you with higher rental income, future flexibility and lower risk, while also diversifying your investment portfolio at the same time.

5. Tax Implication and benefits

Apartments usually offer higher depreciation schedules and non cash deductions helping with holding costs and lowering investors tax threshold.

Because you are holding on less land the likelihood of going over the threshold for land tax is very low, what allows you to hold on to more properties that will give you more cash flow.

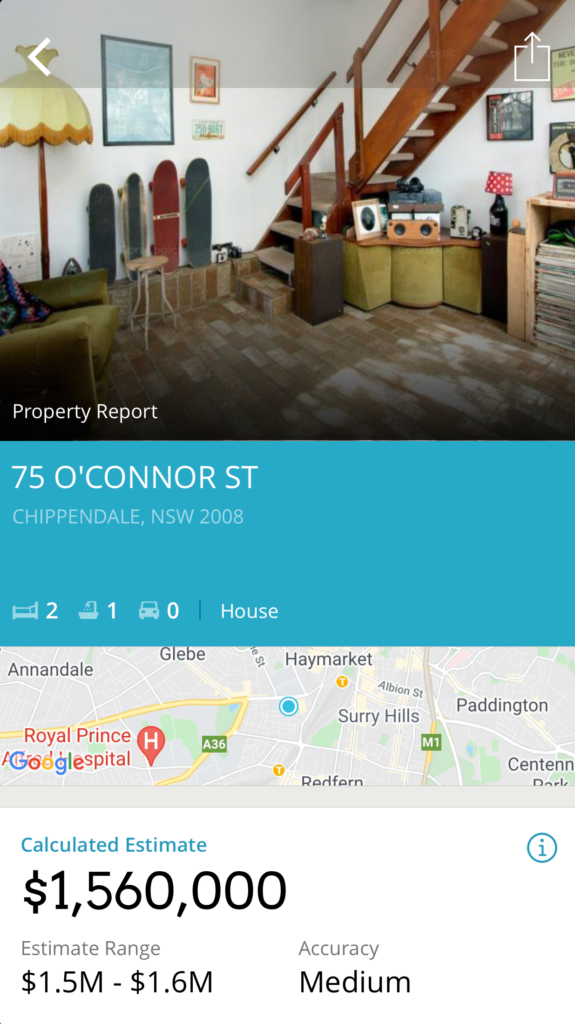

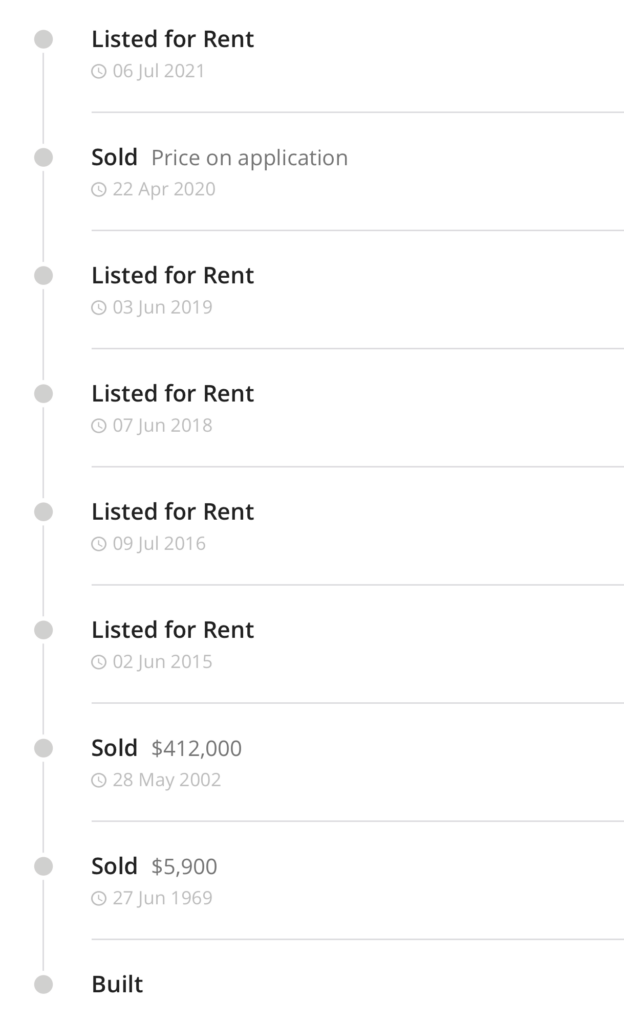

Taking the Sydney market as an example see below a house and a 1bed unit and their history in the market. For those that don’t believe that apartments have capital growth.

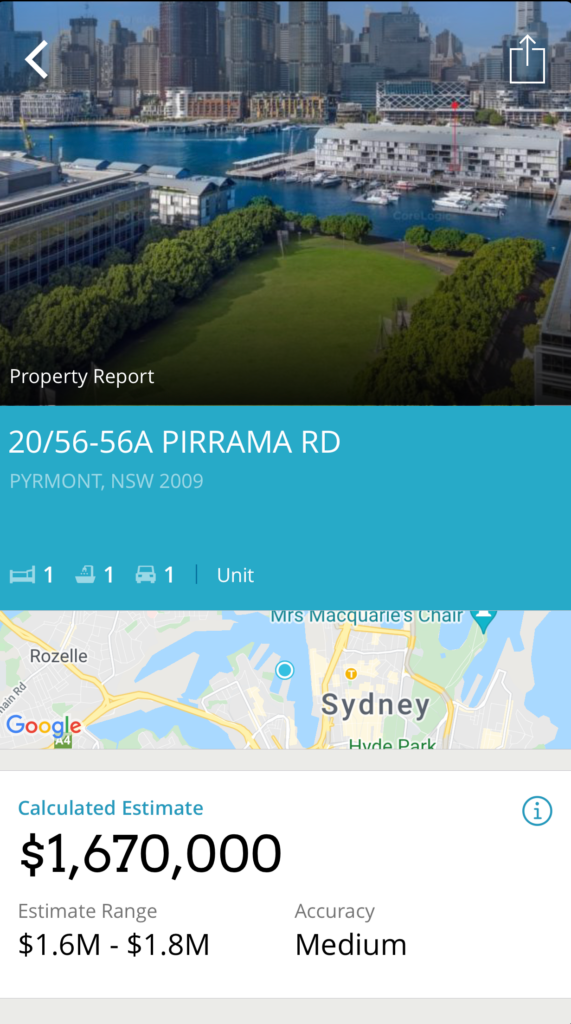

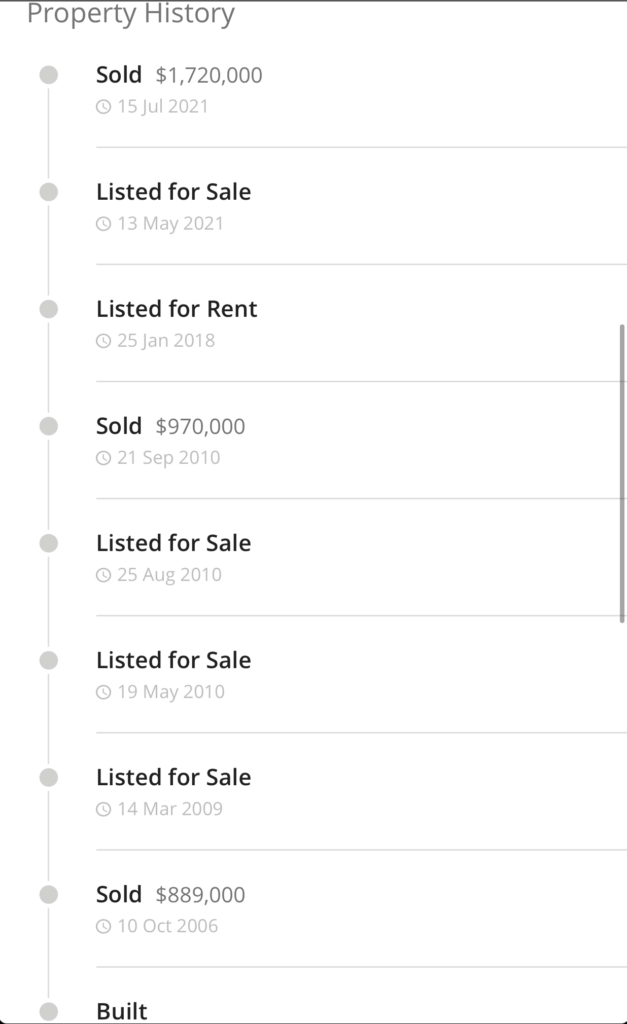

Now how does an apartment compares?

Interested in taking the opportunity to buy an apartment or a house?

Interested in some great projects?

share to