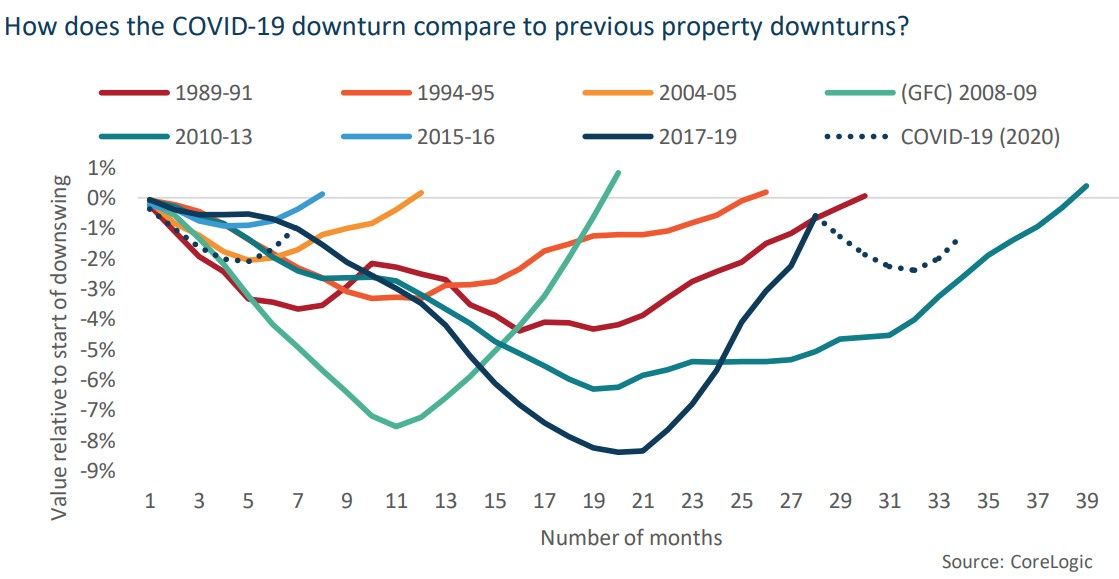

However, national housing market values declined just 1.9% between March and September.

Housing market values are now recovering, increasing 0.4% nationally through October and 0.8% in November.

Relative to previous housing market downturns, the current decline through to November seems relatively mild, with dwelling values just 0.7% below the pre-COVID levels. Other housing market indicators corroborate a trend towards a recovery in values.

In the 3 months to November, CoreLogic sales volume estimates rose to be 0.9% higher than in the equivalent period of 2019.

The Westpac-Melbourne Institute ‘time to buy a dwelling’ index increased by 10.6% in October, and by another 8.0% in November.

New listings added to the market in the four weeks ending 29th of November rose to around 40,000, as Melbourne listings volumes more than tripled coming out of restrictions in the September quarter.

The combined capital cities auction clearance rate averaged to 69.8% over the four weeks to November 29th, which is higher than in the equivalent period of 2019.

Auction volumes also rose to an average of around 1,864 auctions per week. This is up from an average clearance rate of 67.6% through October and around 1,350 auctions per week.

Even in Melbourne, where property values and sentiment have been most impacted by the pandemic, the clearance rate for the four weeks ending November 29th was remarkably high at 69.3%.

Several factors may explain the mild fall in Australian property values since March: accommodative monetary policy, such as the new record low cash rate setting of 0.1%. Monetary policy is covered more extensively in the next section of this report. Combined with other factors, the low cost of mortgage debt is increasing demand for property.

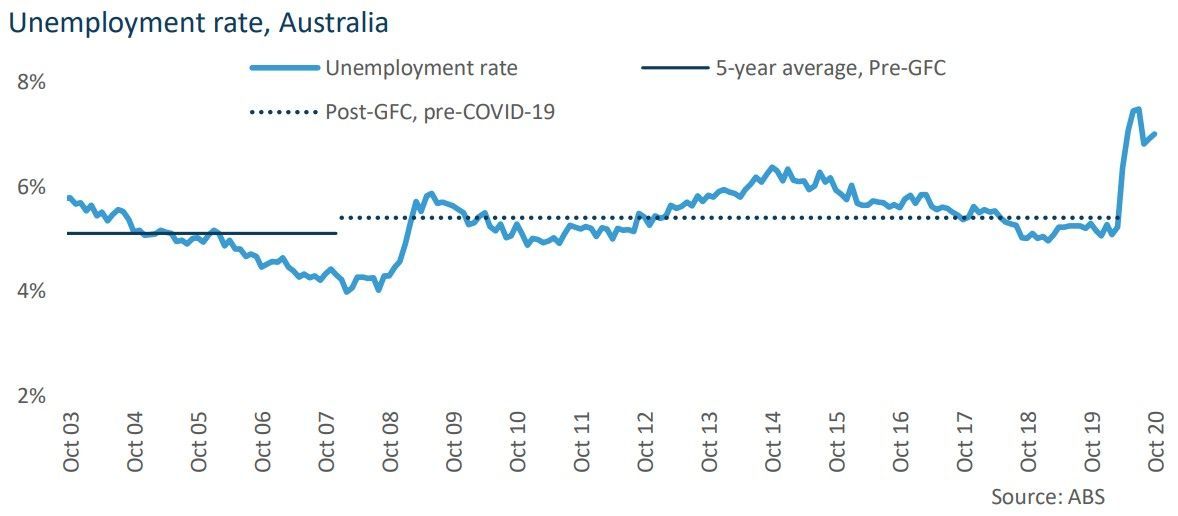

The downturn was manufactured, and much of the job loss was contained to particular industries and demographics.

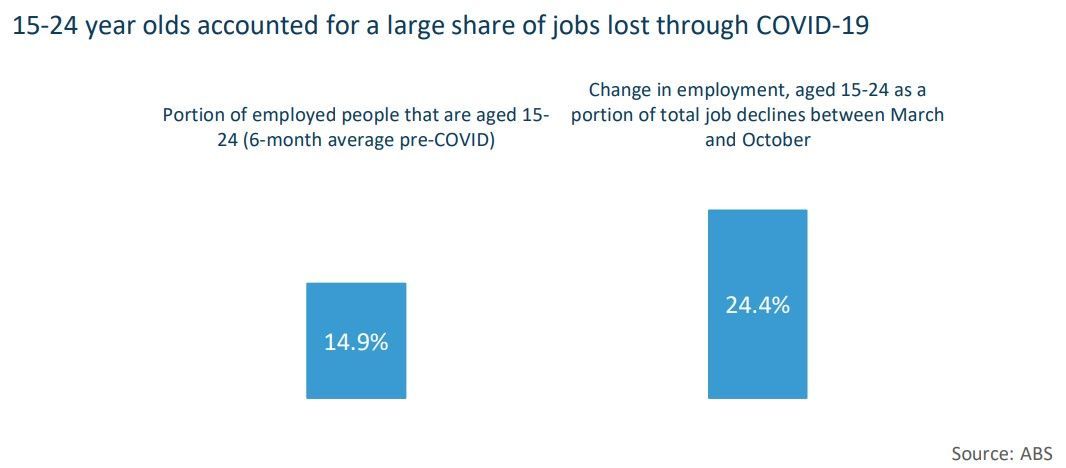

The pandemic has more acutely affected people who are younger, or work in sectors where people are more likely to rent. For example, even though workers aged between 15 and 24 only averaged 14.9% of employed persons in the lead up to COVID-19, they made up 24.4% of job losses from March through to October.

While the economic and social costs of these job declines are devastating, many young workers, or those in precarious job sectors, are less likely to have mortgage servicing obligations.

Mortgage repayment deferrals and subsequent low levels of stock for sale.

The Australian Prudential Regulation Authority (APRA) were part of a coordinated response in ensuring stability of the finance sector at the onset of the pandemic.

On March 23rd, APRA announced that deferred repayment plans in response to the pandemic would not be treated as loans in arrears until September 2020.

In July, this concession was extended₅ on a case-by-case basis until the 31st of March 2021.

This allowed banks to extend deferrals, which likely limited forced sales and contributed to a decline in listings amid the height of economic uncertainty.

As of October, these deferrals have fallen to just 4% of all housing loans, suggesting the extension of deferrals is increasing housing market stability while jobs are reabsorbed and the economy improves.

However, not all property markets were mildly affected by COVID-19.

The previous sections of this report highlight how different trends and varied performance are emerging across types of stock, buyer profiles and geographic regions. But despite the variance present, there is a broader-based upswing trend emerging across property values, which we expect to continue into early 2021.

A gradual return to growth in the Australian economy and housing market seems likely, but is still subject to risks.

I hope you enjoyed this post. Another great insight from Tim Lawless from Corelogic.

Did you like this post? Do you have any property questions? Need some help? Let‘s have a chat.

At the initial onset of the pandemic, consensus around the trajectory of property market values was a decline ranging from a base-case scenario of 10%, to worst-case scenarios seeing property values fall by almost a third.

share to