This is one of the most misconceived points of view

As soon the market changes or Owner Occupiers are not able to buy anymore what and where they would like to Property Investor get crucified.

What people tend to forget that most Property Investors are just normal mom and dads that do not want to rely on the pension.

Before we dig into this polemic topic let’s talk about the pension.

The Pension

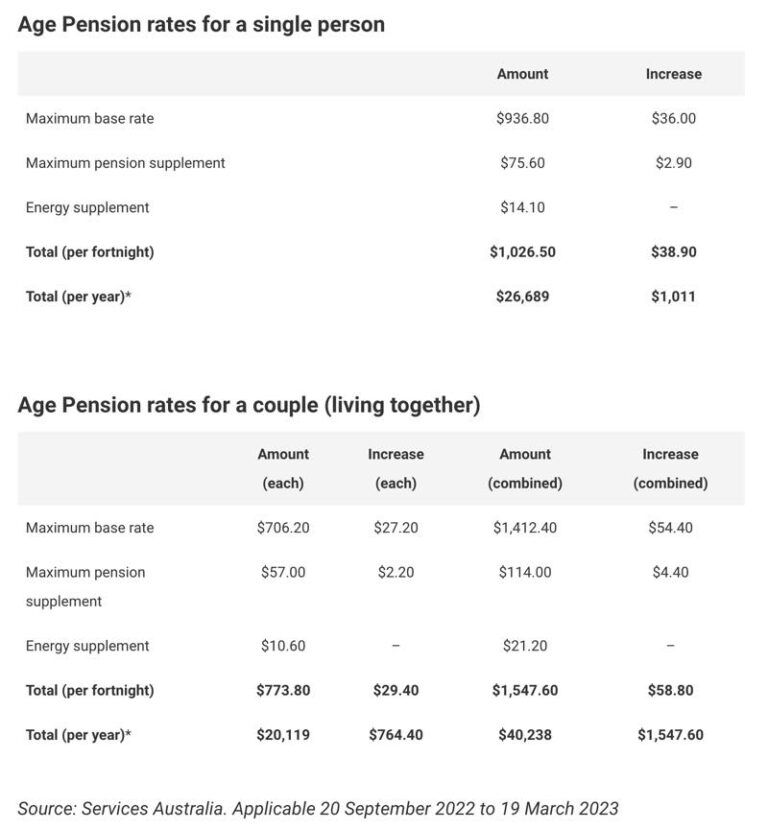

Latest Age Pension rates (from 20 September 2022)

From 20 September 2022 the maximum full Age Pension increases $38.90 per fortnight for a single person, and $29.40 per person per fortnight for a couple.

The rates for a full Age Pension for Australian residents for the period 20 September 2022 to 19 March 2023 are listed below:

- Single: $1,026.50 per fortnight (approximately $26,689 per year)

- Couple (each): $773.80 per fortnight (approximately $20,119 per year)

- Couple (combined): $1,547.60 per fortnight (approximately $40,238 per year)

- Couples separated due to illness each receive the Single rate (see above), which combined is $2,053.00 (approximately $53,378 per year)

Note: Annual amounts are approximate. The figures above include the pension and energy supplements.

*The tables below provide more detail in terms of the latest increase and how the Age Pension is broken down.

What people tend to forget is that it’s not something automatic. In order to get the pension you still need to pass both an income test and an assets test.

Income test

To qualify for a full Age Pension as a single person your income must be below $190 per fortnight (approximately $4,940 per year), but you can still be eligible for a part Age Pension if you earn less than $2,243.00 per fortnight (approximately $58,318 per year).

For a couple, to qualify for the full Age Pension your combined income must be below $336 per fortnight (approximately $8,736 per year), but you can still be eligible for a part Age Pension if you earn less than $3,431.20 per fortnight (approximately $89,211 per year).

It’s important to note that you can earn up to $300 per person per fortnight from working and this amount is not included in the Age Pension income test. This is known as the work bonus.

Note: The above thresholds apply 20 September 2022 to 19 March 2023.

Assets test

To qualify for a full Age Pension as a single person your assets must also be valued below $280,000 if you own your own home, or $504,500 if you don’t own your own home.

You can still be eligible for a part Age Pension if your assets are worth less than $622,250 if you own your own home, or $846,750 if you don’t own your own home.

For a couple to qualify for the full Age Pension, your combined assets must be below $419,000 if you own your own home, or $643,500 if you don’t own your own home.

You can still be eligible for a part Age Pension if your assets are worth less than $935,000 if you own your own home, or $1,159,500 if you don’t own your own home.

Note: The above thresholds apply 20 September 2022 to 19 March 2023.

Let’s go back to property investors

So basically if you do not wish as a couple to live on $40K a year and live in a very cheap home, you must now start planning for your retirement.

This is why most people are drawn to Property Investing as it’s one of the safest asset class they can invest into and at the same time gives them some tax relief.

Unfortunately the only thing people like to complain about is that Property Investors are taking stock out of the market, or they don’t give first home buyers a chance to get into the market because they push up prices.

On top of that the Government is helping to fund all this by allowing people to claim negative gearing.

So let’s clear up this misconception.

Everybody gets negative gearing no matter what assets they have. So if we talk about shares if the dividends don’t cover their interest repayments they can claim negative gearing;

Or if you run a business and you borrow money to refurbish your shop or buy stock you can claim the interest as negative gearing; You can claim losses in a business and profits in another part of your business.

Or if you don’t have other income you can recoup it later on;

Then we can touch base on another very polemic topic that is the 50% CGT discount that people believe to be only available to property owners;

So basically uneducated people believe that not only property investors get negative gearing but they get as well 50% CGT discount when they decide to sell.

Now, again, this discount is available to everyone that holds any type of assets from shares, bitcoin, vintage cars, painting collection;

Anyone that has an asset will be able to benefit from 50% discount in CGT as long they hold that asset for more than 12 months;

But what people don’t realise is that property is the highest tax asset class.

When you buy an investment property you need to pay stamp duty, land tax, GST. None of these taxes apply to your shares!!!

And the negative gearing aspect depending on the particular year you are looking at is about $4-$10BI cost to the budget every year. Meaning that people’s expenses are about $4-$10BI more than their income;

But the other side of the coin is State Governments revenue is 40-50% generated from property tax related transactions, around $100BI year.

What people need to remember is that the only reason why the ATO gives you a 50% discount in CGT is because there is an expectation that the asset will go up in value and they will recoup it when you transact that asset again, making much more money.

So property is one of the major drivers of the Australian economy and it’s almost a guarantee that if people invest now they won’t need to be on a pension what will help the Government spend less money looking after the elderly.

If you look at property from a holistic perspective you will see that is the leaver the government uses to move the economy, so if people buy more property they will need more services.

They will need to buy furniture, insurances, appliances, they will need tradies to do renovations.

The property market itself is one of the major stimulus that our economy has to keep growing and moving forward.

So next time you read about or hear about how property investors are bad and the property bubble will burst you can choose not to engage into that idea.

By allowing the property market to crash all the government is doing is shutting down the economy.

Why would they do that?

share to