While always considered an affordable market the last 2 years changed everything

Cat Riddle, Communication Officer, Queensland Tourism Industry Council said:

“Queensland has long been an attractive market for holiday and leisure seekers due to our unbeatable climate and lifestyle.

What has really come to the fore in recent times are the opportunities to make a significant lifestyle shift and enjoy the Queensland way of life year-round.

This sentiment really shines through when analysing local property market trends and witnessing the demand and market growth for homeowners and investors across the state – an unprecedented increase in interest and transactions from local, domestic and foreign buyers who are eager to call the Sunshine State home.

Factoring the significant shift and re-prioritisation of lifestyle factors many are experiencing as a result of the pandemic, paired with our exciting lineup of infrastructure and development projects due to Brisbane’s 2032 Olympic success, Queensland continues to strengthen its credentials as both a short and long term location that truly offers something for everyone.”

Queensland is set to experience a “once in a generation” infrastructure boom in the lead-up to the 2032 Olympics.

According to Dr. Nicola Powell, author of Domain’s Queensland Spotlight Report as a result, infrastructure across Gold Coast, Brisbane, and Sunshine Coast will vastly improve and there will be a clear roadmap and timeline for the housing infrastructure to be implemented over the next decade.

This will also provide assurance to buyers and business owners that proposed developments will indeed take place as and when forecasted.

Dr. Powell, Senior Research Analyst for Domain, explained that big infrastructure projects leave a legacy behind helping to lift the population and benefit the local community in the long term.

She said that an influx of capital and subsequent job creation, which is expected to be the equivalent of 91,000 full-time jobs in Queensland, in the lead up to the games will be an economic force for South East Queensland.

As a part of this cash injection, we will naturally witness significant demand for housing, especially as we prepare to welcome skilled workers to the state.

According to Dr. Powell, what we can forecast is an increased demand for rental properties to host short-mid term workers, which naturally presents opportunities for investors to capitalise on the strong rental demand.

Its success in securing the 2032 Olympics is a game-changer that will enhance the current infrastructure boom and we suspect increasing numbers of home buyers and investors will want to buy a piece of Brisbane.

Brisbane’s median house price at 1 October 2021 was $709,000 while the median house price was $962,000 in Melbourne and $1,311,000 in Sydney. At $430,000 Brisbane’s median apartment price is almost half of that in Sydney ($825,000).

As the spotlight falls increasingly on Brisbane, thanks to everything the Olympics will unleash, there is potential for growth to close the price gap with the larger cities.

Research suggests that suburbs close to the main Olympic venues show the greatest price uplift.

Here is a list of some of the Suburbs with potential:

10 of the best suburbs to buy in Brisbane

Tim Lawless of Core Logic recently commented:

Brisbane doesn’t show the same affordability challenges as the larger cities, which may help to explain the persistently high rate of growth, but also fewer outbreaks of COVID and a strong interstate migration tailwind supporting housing demand in the absence of overseas migration.

Brisbane housing values are now 18.3% higher over the year, which is a similar result to the national average, where the housing values are 18.4% higher.

The number of home sales across Brisbane over the past twelve months is approximately 41% higher than the five-year average, while total active listings are 30% below the five-year average.

This significant gap between available supply and demonstrated demand is another reason for the consistent lift in housing prices.

Why Investors always get the blame?

Recently a lot of the news out there condemn Property Investor activities as they were the reason why property prices skyrocketed over the past 2 years since Covid hit.

Well I hate to break it to you but that’s not what is actually happening.

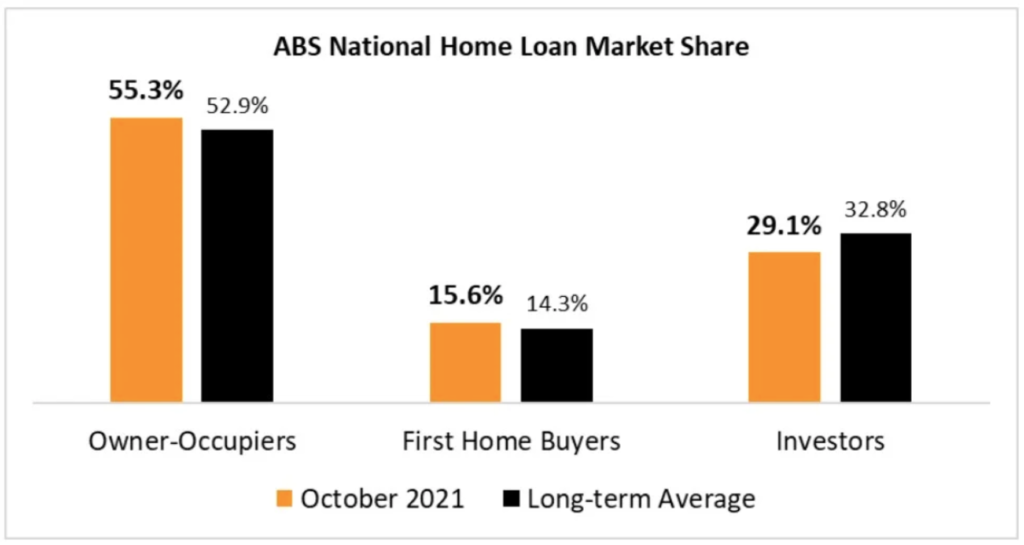

The investor market share of total residential lending has fallen from 42.5% in June 2015 to the current 29.1% and despite recent growth remains below the long-term investor average of 32.8%.

It’s important to remember that high levels of investor activity in 2015 encouraged APRA – the financial regulator for the big banks – to initiate actions designed to reduce investor lending predicated on then-booming home prices and fears of imminently rising interest rates.

Currently, however, investor activity remains relatively low, housing markets are clearly cooling as prices growth wanes – particularly in the primary investor markets of Sydney and Melbourne – and importantly the RBA continues to stipulate that interest rates will not rise until at least 2024.

Although reviving, investor activity clearly remains in the doldrums and with the national shortage of rental properties reflecting the restrictive policies of recent years pushing rents through the roof.

With lockdowns having ended in October, the prospect of a sharp rebound in economic activity is clearly likely over the December quarter with a sustained recovery set to continue over 2022.

Although challenges remain with the emergence of coronavirus variants, the Australian economy has again proven resilient with consumer confidence rising with the ending of coronavirus elimination policies through lengthy lockdowns.

Australia has one of the strongest property markets in the world and no matter what time + property = Safe Investment.

share to