What's happened to house and unit rents in your capital city?

Domain.com.au has an awesome report that comes out every month showing market trends all over Australia. Here is what they say about Sydney.

Sydney

Sydney rental prices have been swiftly adjusted to changes in supply and demand induced by pandemic associated restrictions. Tenants in the inner-city will have benefited from greater falls in asking rents and be better placed to negotiate than those outer suburbs. Changes in demand have been more pronounced in inner areas because they have a greater exposure to international students as well as lockdown job losses. They are also more likely to have properties that have been converted from holiday leases to private rentals. Tenants have a unique opportunity during this rental shift, whether by nabbing a lower price or being able to afford a home with more amenities.

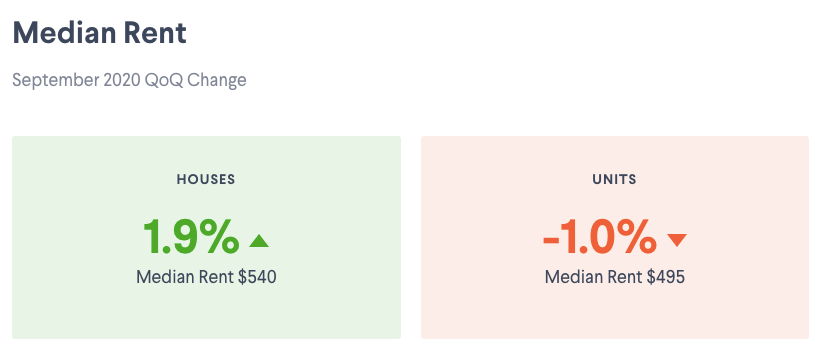

Unit asking rents dropped further over the September quarter, posting a 4.8 per cent decline since March, or $25 shaved from median weekly asking rent. This is the deepest fall over two consecutive quarters since the start of Domain’s Rent Report in 2004. Unit rents have now fallen $55 a week from peak prices in 2017 and are now the lowest in six years.

Since March, house and unit asking rents in the city and east region have had the largest decline in Sydney - by $125 and $80 a week, respectively. This is followed by a $70 a week reduction to unit asking rents in the lower north shore. These are the only areas in Sydney to record double-digit percentage falls over this six-month period. Tenants are now paying the same price they were in 2013.

International and domestic travel has taken a substantial hit, which means a large number of short-term holiday homes have moved to the long-term rental market. While domestic tourism is returning as restrictions ease, many former holiday-lets remain advertised for long-term rent. There are fully-furnished high-end luxury properties available to rent in some of Sydney’s elite beachside suburbs that were once only premium holiday homes. When international borders open, allowing migration and tourism to resume, demand for rentals will lift. This is likely to coincide with reduced dwelling construction and investment activity, and this will eventually help to rebalance the rental market.

For the full report just use this link: https://www.domain.com.au/research/rental-report/september-2020/

share to