our simple property dictionary

Have you ever found yourself into a conversation with a property enthusiast where they start using words that you have no idea but just pretend you know what they mean?

Just like you many people find themselves in the same situation.

So I thought I’d make it simple by listing some of the most common ones.

Let’s start with a very basic one:

Investment Property

Investment property is a property that you own, but you don’t live into, that is rented out and gives you an income.

Owner Occupied Property

This is the property you live into, that relies 100% on your income in order to pay down it’s debit. It does not give you an income while you are living in it, but will still grow in value with time and once you sell it in the future would have make you some profit.

Capita Gain Tax - CGT

CGT is the tax you pay on the profit you receive when you sell an asset or investment. The tax will be calculated based on your yearly income and your tax trash hold. In Australia if you hold an Asset for over 12 Month you receive a discount of 50% on CGT

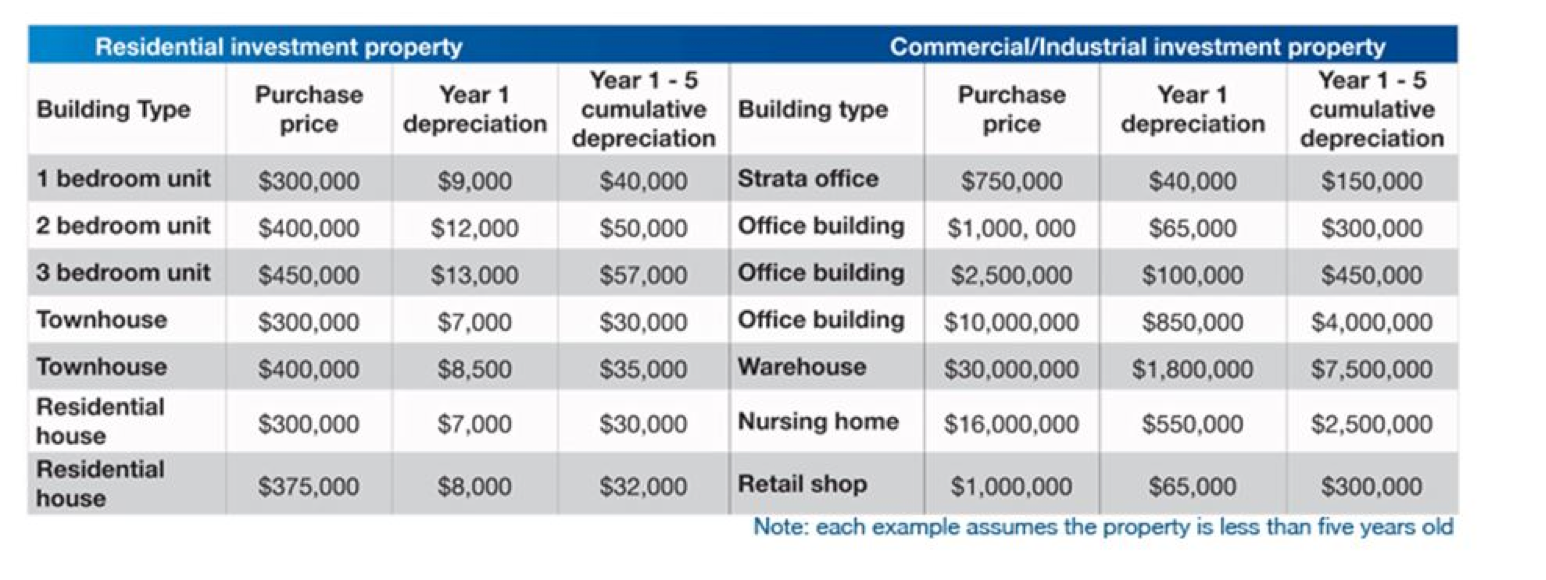

Depreciation

It’s the monetary value of an asset decreases over time due to use, wear and tear or obsolescence. This decrease is measured as depreciation.

As a building gets older, items wear out – they depreciate. The Australian Taxation Office (ATO) allows owners of income producing properties to claim this depreciation as a deduction.

Unlike other deductions, such as interest on a loan where you need to outlay money in order to make a claim, depreciation is considered a “non-cash tax deduction.”

There are essentially two types of property depreciation investors can claim:

- Capital Works Allowance (Division 43); and

- Plant and Equipment (Division 40)

Capital works allowance is a deduction available on the structural element of a building, including fixed irremovable assets. It is commonly referred to as ‘building write-off’ and includes items such as roofs, windows and doors. When calculating the capital works allowance, the building’s historical construction cost is used 2.5% of this can be claimed each year for up to 40 years.

The plant and equipment deduction is available for mechanical or removable assets only in brand new properties. This includes items such as carpets, hot water systems, blinds and light fittings.

For plant and equipment, deductions are calculated using the effective life of each fixture or fitting (generally 5-10 years). For example, a dishwasher may be allocated an effective life of 10 years and will be depreciated at 20% per year (using the diminishing value method of depreciation).

If you need a Depreciation Schedule Done here is a link for you with a discount.

Landlord Insurance

Landlord insurance is a type of insurance policy specifically designed to protect those who own investment properties from the risks that come with renting it out. It generally covers events that cause a loss of rental income, theft or damage to your property.

There are generally three components of landlord insurance:

- The part that covers loss of rental income

- ‘Building insurance’ which covers damage to the property’s structure

- ‘Contents insurance’ for protection against damage to what’s inside the property (e.g. carpet, appliances)

Landlord insurance can apply to all sorts of investment properties, whether it’s a house, unit, apartment or townhouse.

Building Insurance

Building Insurance covers the structure of your property. It includes cover for garages and sheds, as well as permanently attached fixtures and fittings, such as solar panels, fences and gates.

A Home Building Insurance policy can provide cover for damage caused by events such as flood, storm, storm surge, fire (including bushfire), and more.

If you own an investment property that is Strata Titled most of the time this insurance is already included and paid by Strata. But when you own a free standing home you need to purchase and pay for this insurance separately.

PAYG withholding variation application

This is a form that you will fill for the ATO that allows your employer to withhold less tax from you upfront.

The main purpose of varying or reducing the amount of withholding is to make sure that the amount withheld during the income year best meets your end-of-year tax liability.

For example, you may want to apply for a variation if the normal rate of withholding leads to a large credit at the end of the income year because your tax-deductible expenses are higher than normal.

So if you have an investment property and you know already how much you will be spending a depreciating with it you can get that money prior to the end of the financial year.

Rental Yield

When you own an investment property and it’s rented out you earn a weekly rent.

Rental yield is essentially the amount of money you make on an investment property by measuring the gap between your overall costs and the income you receive from renting out your property.

Here’s how to calculate gross rental yield:

- Sum up your total annual rent that you would charge a tenant

- Divide your annual rent by the value of the property

- Multiply that figure by 100 to get the percentage of your gross rental yield

Here’s an example of calculating gross rental yield.

Let’s say, you receive $30,000 each year in rent, and the property is worth $500,000. Your gross rental yield is equal to $30,000 ÷ $500,000 X 100 = 6%.

Negative Gear and Positive Gear Property

Negative gearing is a tax benefit you can claim if your borrowing costs are higher than the money you’ve made from an investment property. These losses can be claimed against your total income and increase your tax return and therefore, your income on your investment.

Most investors are willing to accept a loss in income if they believe they will be compensated by capital growth in the future.

Positive gearing is the exact opposite of negative gearing, this is when the income from your investment property exceeds the cost of owning the property when you take into account your loan repayments, interest and all other out of pocket expenses (like rates, water and maintenance costs).

If you have a property that is positively geared, you will be enjoying a net gain from your investment. If you are making an income from the investment it is cash flow positive.

One of the things I love the most is negative geared properties but cash flow positive. Do you want to know how? Get in touch.

share to