Nothing much has changed in the property market by the looks of if.

With the number of states recording more covid-19 cases as the virus continues to spread just how it affects not only those trying to buy and sell but land laws and rent as well.

At an interview for Sky News John Healy from realestate.com.au gives a little snapshot of what is happening.

For renters the NSW government announced the 60 days freeze on evictions for tenants whose income have been reduced by 25% or more as a result of the lockdown.

For landlords who are helping some of their tenants with rental relief there are oslo some land tax rebates on offer or a payment of $1500 for landlords who are not required to pay land tax.

All these initiatives are welcomed to minimize the impact on the rental market in the short term.

For Sellers winter is traditionally a quieter period so it’s expected that some sellers my wait till restrictions are lifted and that could lead to avery busy Spring selling season provided that the current lockdown is cleared by then.

For Buyer sells will continue but Auctions will be limited some of them going online. Prices are expected to continue to rise, maybe not as fast as we have experienced before the lockdown.

Beyond the lockdown economist are predicting a likely return to a strong rebound of sales activity, listing volumes and prices in Sydney as was the case in Melbourne following its near four months of second Lockdown last year.

This weekend was no different.

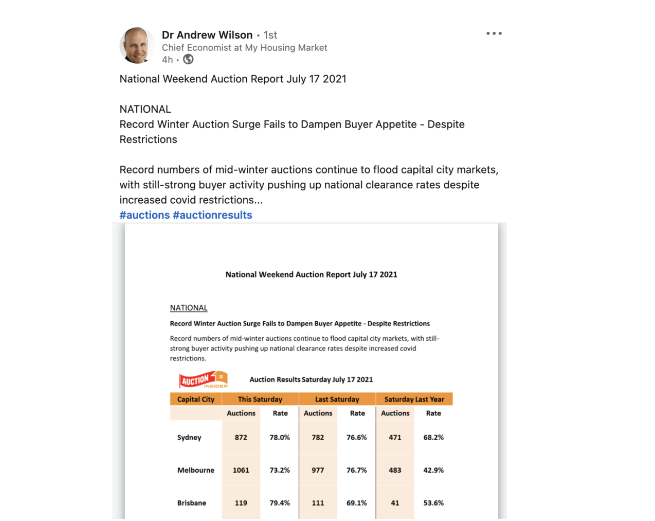

As per DR. Andrew Wilson post.

National Weekend Auction Report July 17 2021

NATIONAL

Record Winter Auction Surge Fails to Dampen Buyer Appetite - Despite Restrictions

Record numbers of mid-winter auctions continue to flood capital city markets, with still-strong buyer activity pushing up national clearance rates despite increased covid restrictions...

Another interesting fact was the list of most viewed property listings, showing that a lot of the buyers on the higher end of the market are using the current environment to jump on unique opportunities when some of the most unique and exquisite properties become available for sale.

Watch the full interview here.

Want to have a chat book a time with me.

share to